FIA And Extreme H Introduce The World’s First Hydrogen Powered World Cup

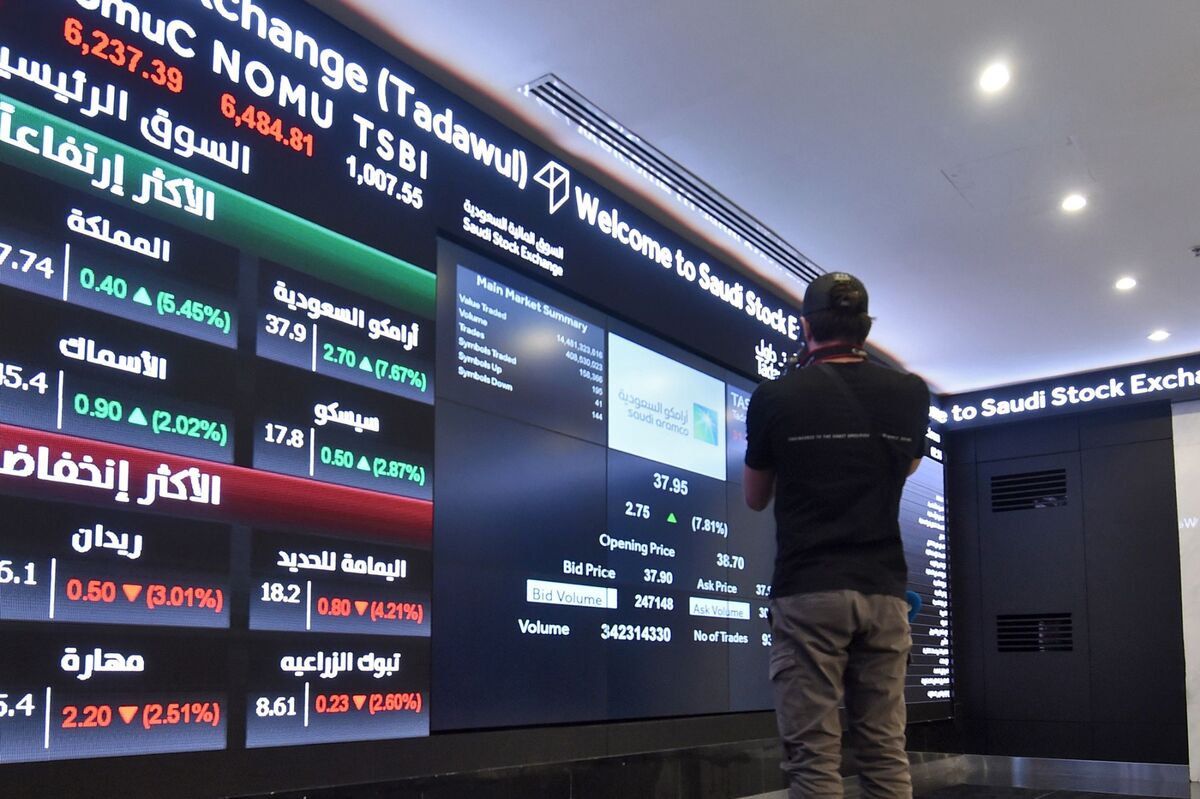

PositiveFinancial Markets

The FIA Extreme H World Cup, set to debut in Qiddiya, Saudi Arabia, from October 9 to 11, 2025, marks a groundbreaking moment as the first international off-road championship powered by hydrogen fuel cell technology. This innovative approach not only showcases advancements in sustainable energy but also highlights the growing commitment to eco-friendly motorsports, making it a significant step towards reducing carbon footprints in competitive racing.

— Curated by the World Pulse Now AI Editorial System