What to Expect From US-China Trade Talks This Week

NeutralFinancial Markets

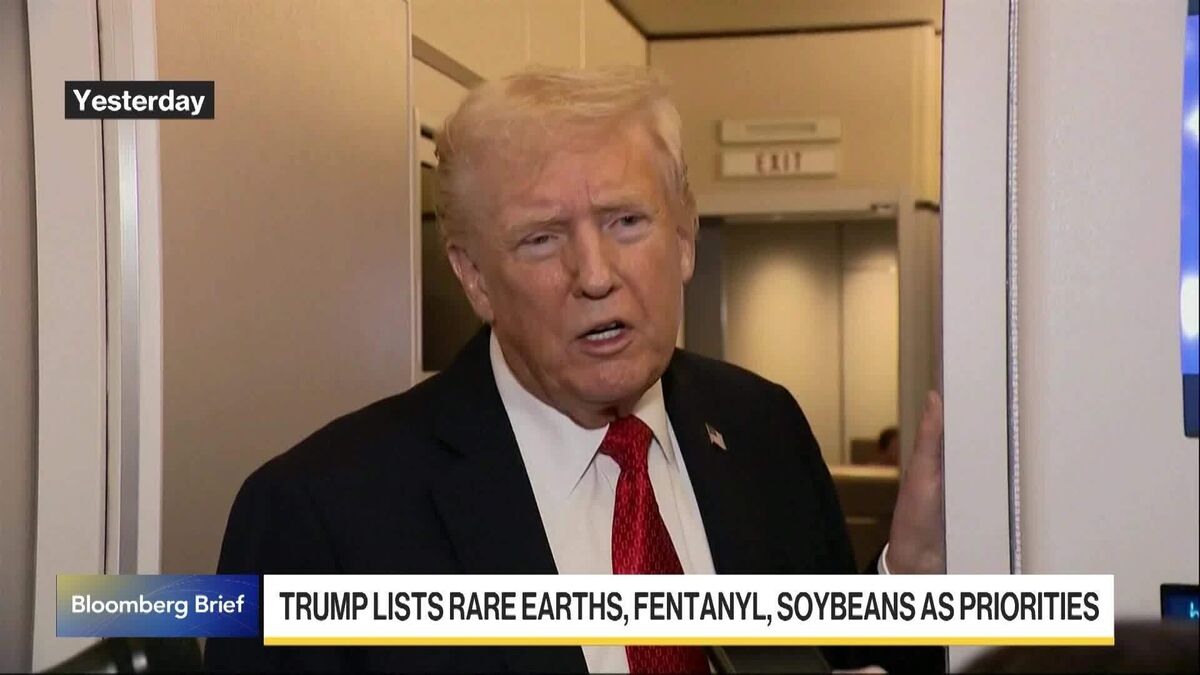

This week, US Treasury Secretary Scott Bessent is set to meet with China's Vice Premier He Lifeng in Malaysia for crucial trade talks. With key issues like rare earths, fentanyl, and soybeans on the agenda, these discussions could significantly impact the economic relationship between the two nations. Understanding the outcomes of these talks is essential for businesses and investors alike, as they could shape future trade policies and market dynamics.

— Curated by the World Pulse Now AI Editorial System