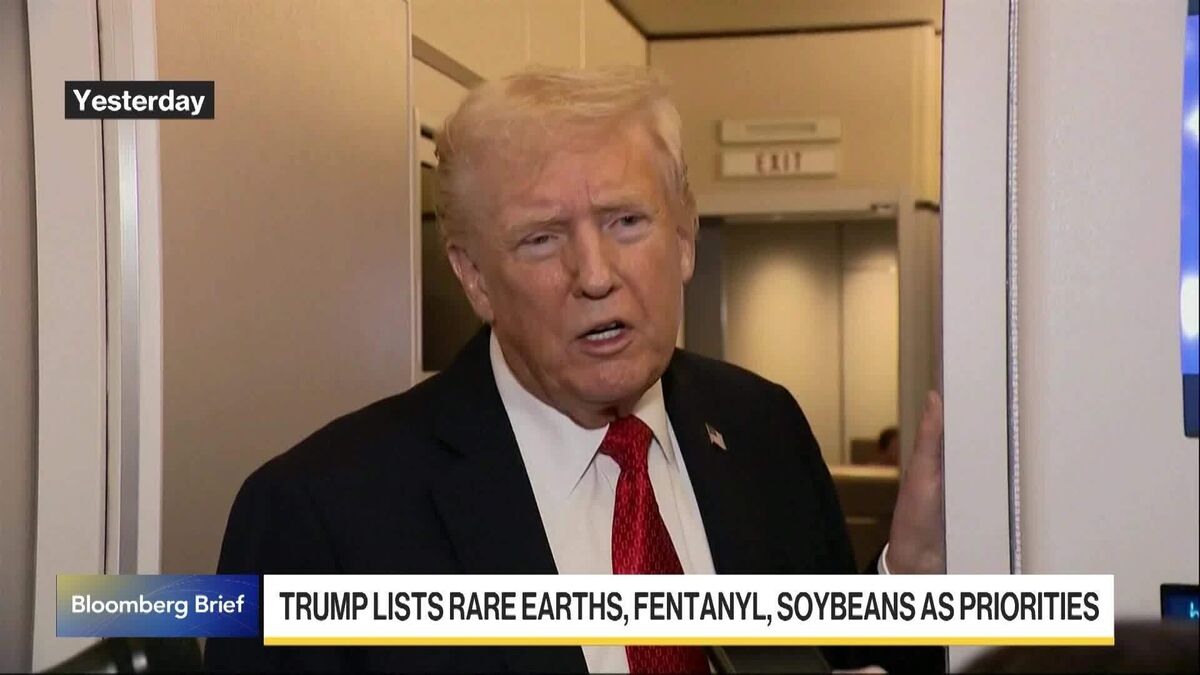

‘Kink’ in VIX Curve Shows Anxiety Over Trump’s Meeting With Xi

NegativeFinancial Markets

As the meeting between US President Donald Trump and Chinese President Xi Jinping approaches, anxiety is rising among options traders, leading to increased demand for protection against potential stock market volatility. This situation highlights the ongoing trade tensions between the two nations, which could have significant implications for global markets and investor confidence.

— Curated by the World Pulse Now AI Editorial System