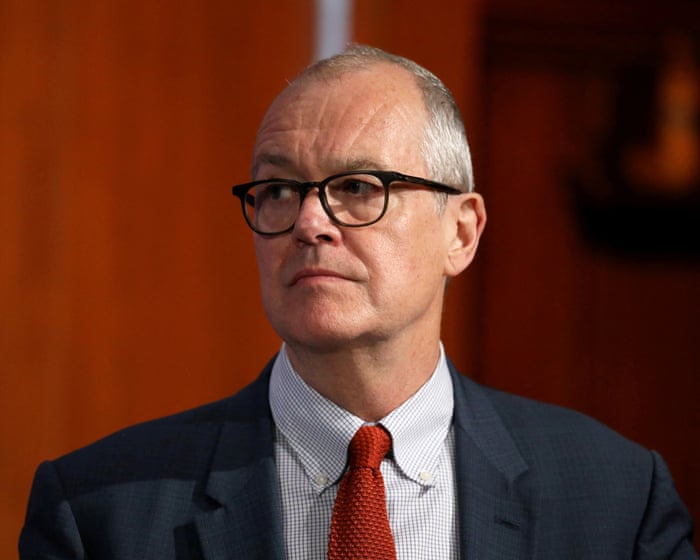

UK set on resolving standoff with big pharma, science minister says

PositiveFinancial Markets

The UK aims to improve its relationship with the pharmaceutical industry and increase NHS investment in medicines, following significant project cancellations by drugmakers.

Editor’s Note: This is important because enhancing collaboration with pharmaceutical companies can lead to better healthcare outcomes and increased availability of essential medications for patients.

— Curated by the World Pulse Now AI Editorial System