How Bill Gates is playing both sides of the climate crisis – video

NegativeFinancial Markets

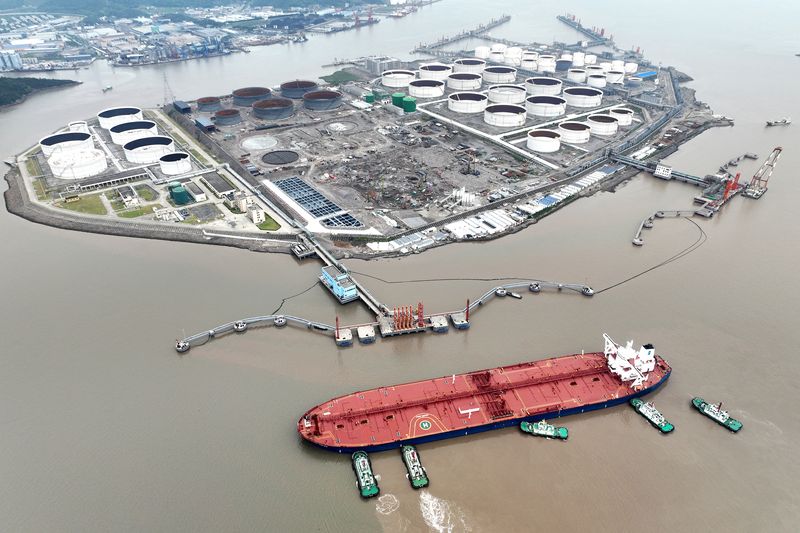

Bill Gates, often seen as a champion for climate solutions, is under scrutiny for his contradictory investments. While he promotes green technologies and advocates for emission reductions, he simultaneously pours money into fossil fuels and other environmentally harmful industries. This dual approach raises questions about his true commitment to combating climate change and highlights the complexities of financial interests in the climate crisis.

— Curated by the World Pulse Now AI Editorial System