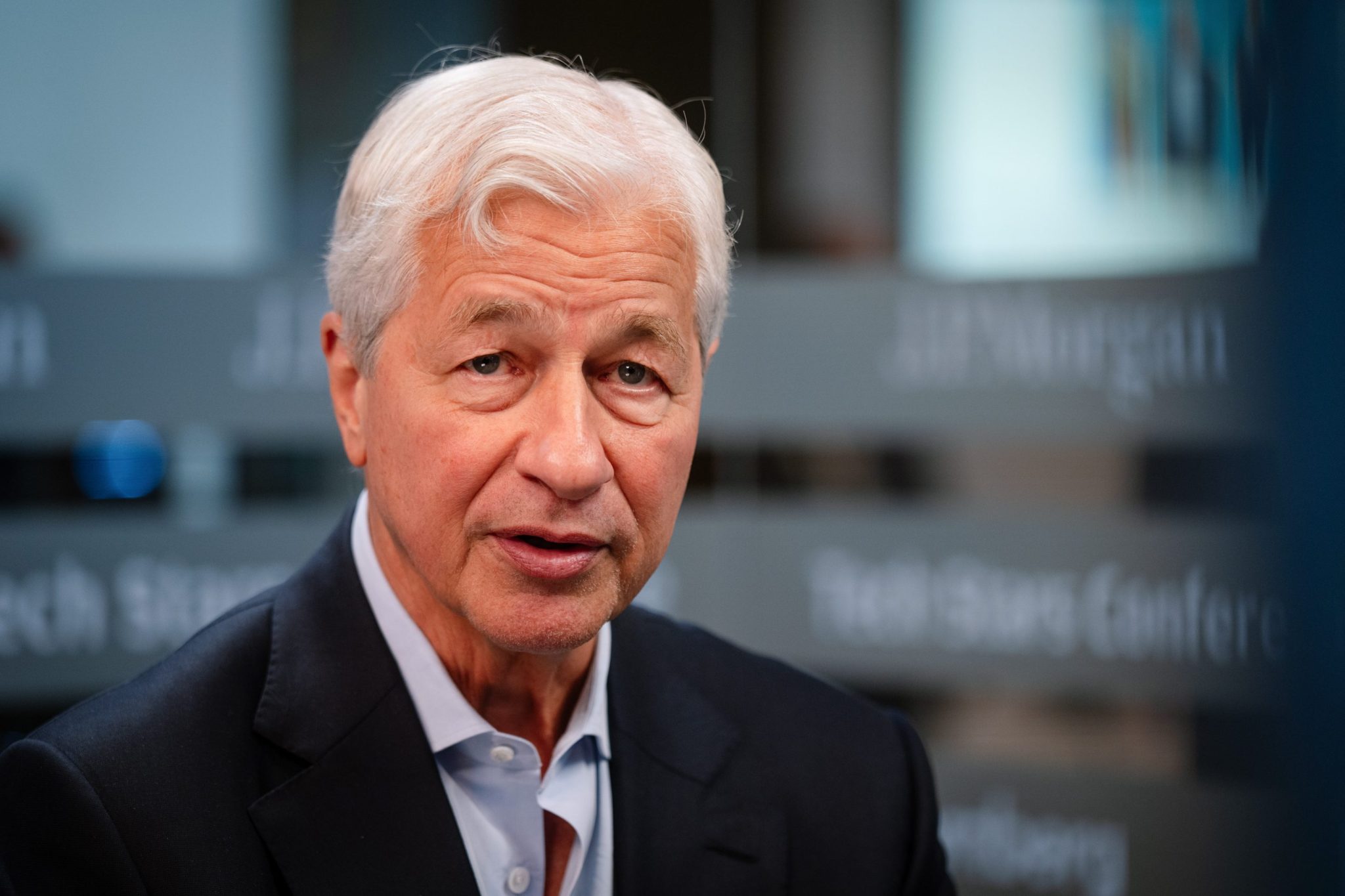

Markets look unstoppable, but JPMorgan CEO Jamie Dimon sees a 30% chance of a correction: ‘I’m far more worried than others’

NeutralFinancial Markets

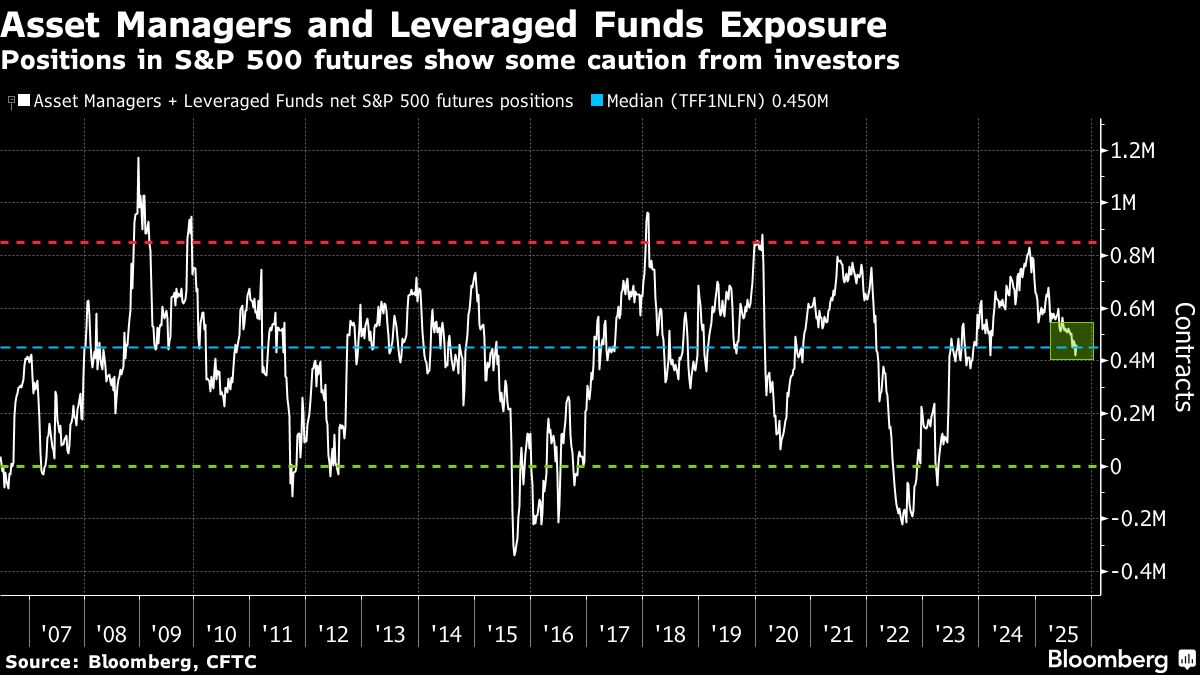

JPMorgan CEO Jamie Dimon has expressed concerns about the current market trends, suggesting there is a 30% chance of a correction. While many investors feel optimistic, Dimon warns that predicting when the bubble will burst is challenging. His insights matter because they highlight the potential risks in a seemingly unstoppable market, prompting investors to consider a more cautious approach.

— Curated by the World Pulse Now AI Editorial System