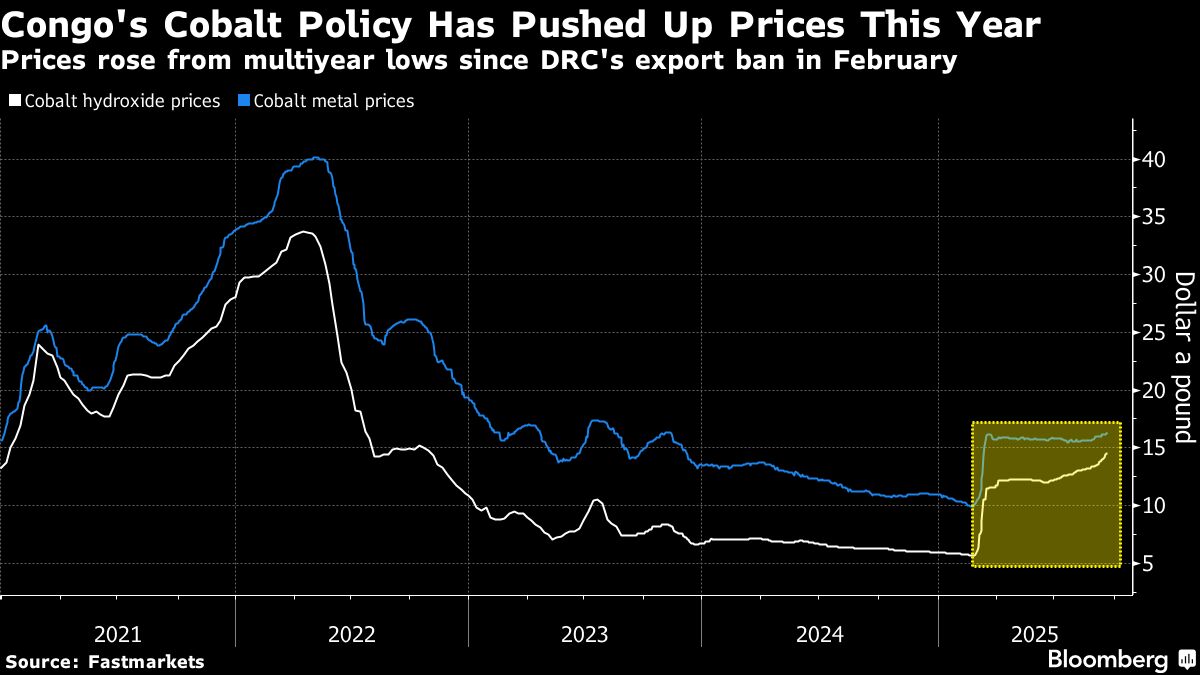

Congo to End Cobalt Export Ban in October, Introduces Quotas

PositiveFinancial Markets

The Democratic Republic of Congo is set to lift its ban on cobalt exports starting next month, introducing quotas instead. This decision is significant as Congo is the world's largest producer of cobalt, a key component in batteries and electronics. By resuming exports, the country aims to stabilize its economy and meet global demand for this essential metal.

— Curated by the World Pulse Now AI Editorial System