Taleb Says Miracle Needed to Solve US Debt Crisis

NegativeFinancial Markets

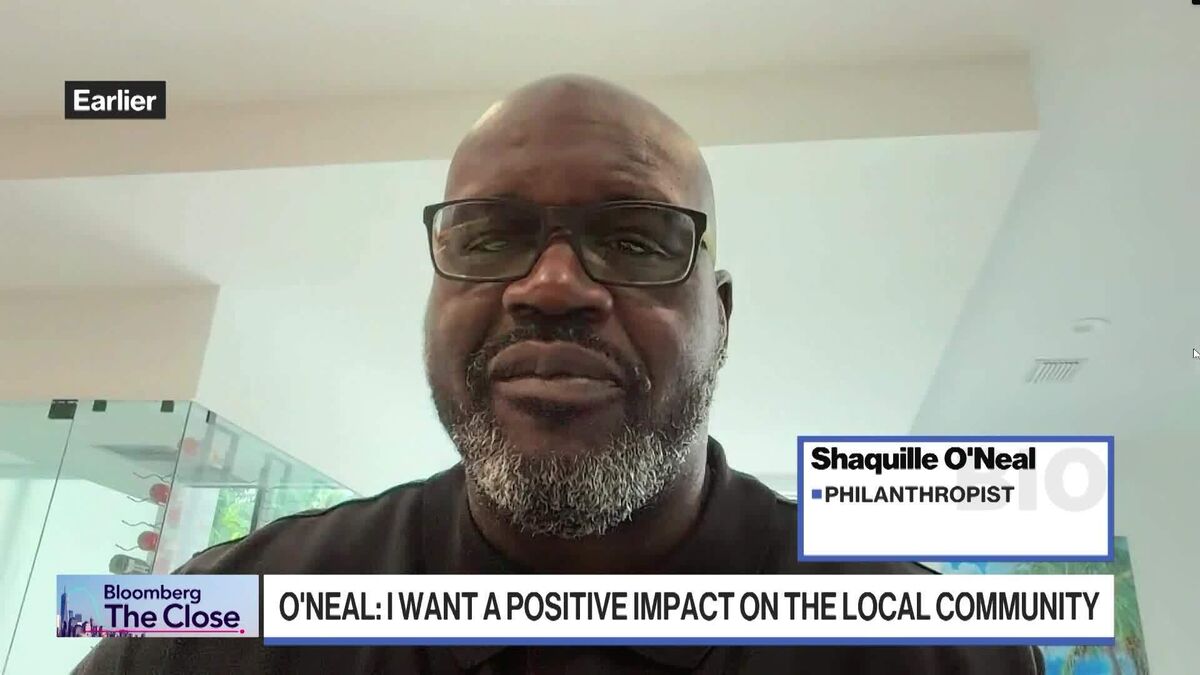

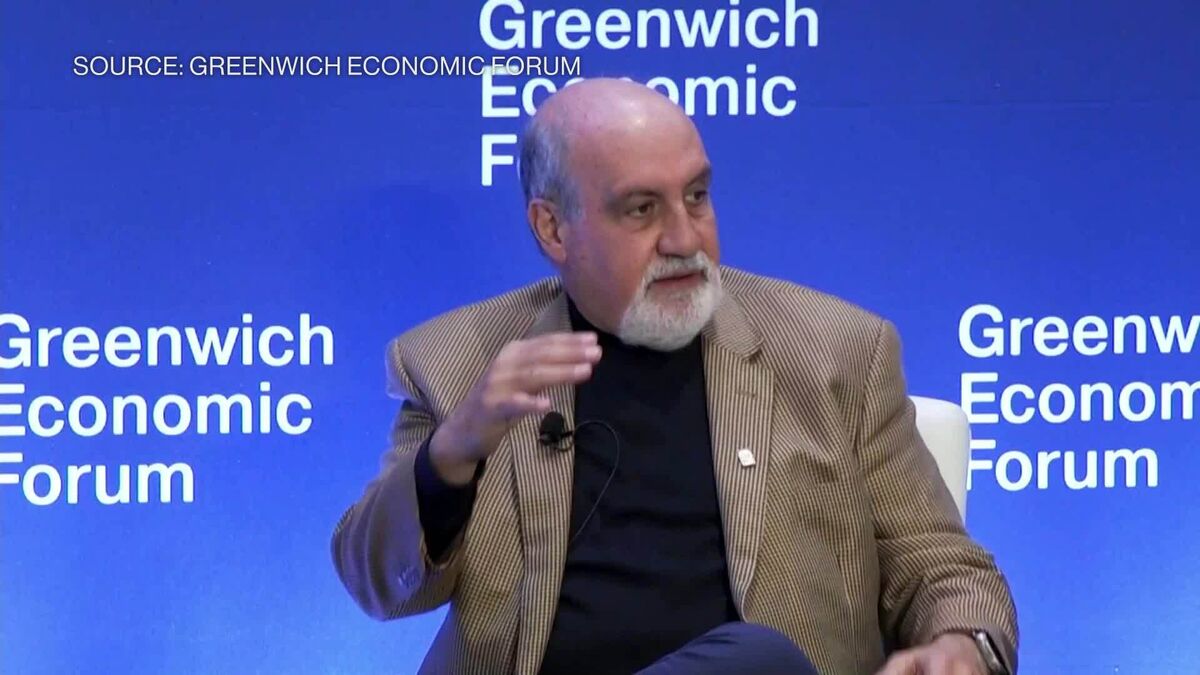

Nassim Nicholas Taleb, a prominent author and scientific adviser at Universa Investments, recently expressed his concerns about the US debt crisis, stating that a miracle is necessary for resolution. In an interview with Bloomberg's Natalia Kniazhevich at the Greenwich Economic Forum, he also touched on the implications of artificial intelligence. This discussion is crucial as it highlights the urgent need for innovative solutions to address the growing financial challenges facing the US.

— Curated by the World Pulse Now AI Editorial System