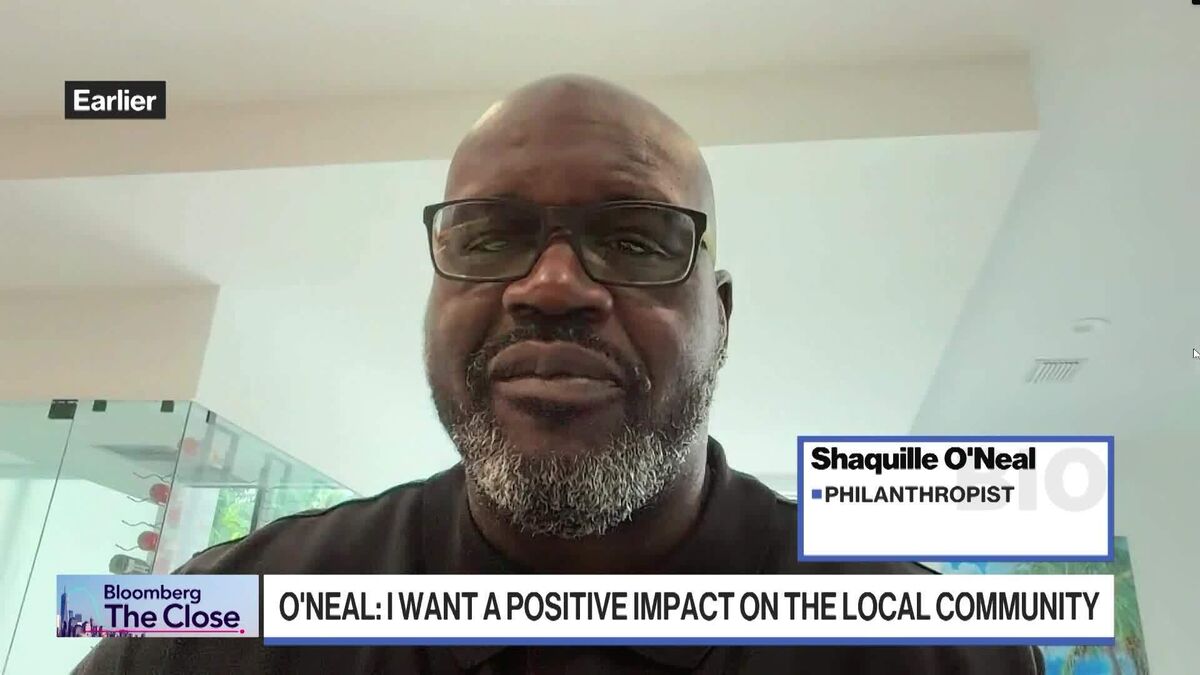

Need Better Infrastructure in US: Shaquille O'Neal

PositiveFinancial Markets

Shaquille O'Neal, the renowned NBA star, is stepping up to address the pressing need for improved infrastructure in the U.S. As a founding partner at Jacmel Infrastructure, he aims to make a significant community impact. Jorge Mora, co-managing partner at Jacmel Partners, highlights that transportation is a key focus for the firm. This initiative is crucial as it not only aims to enhance the nation's infrastructure but also to foster positive change in communities, making it a noteworthy development in the ongoing conversation about public works.

— Curated by the World Pulse Now AI Editorial System