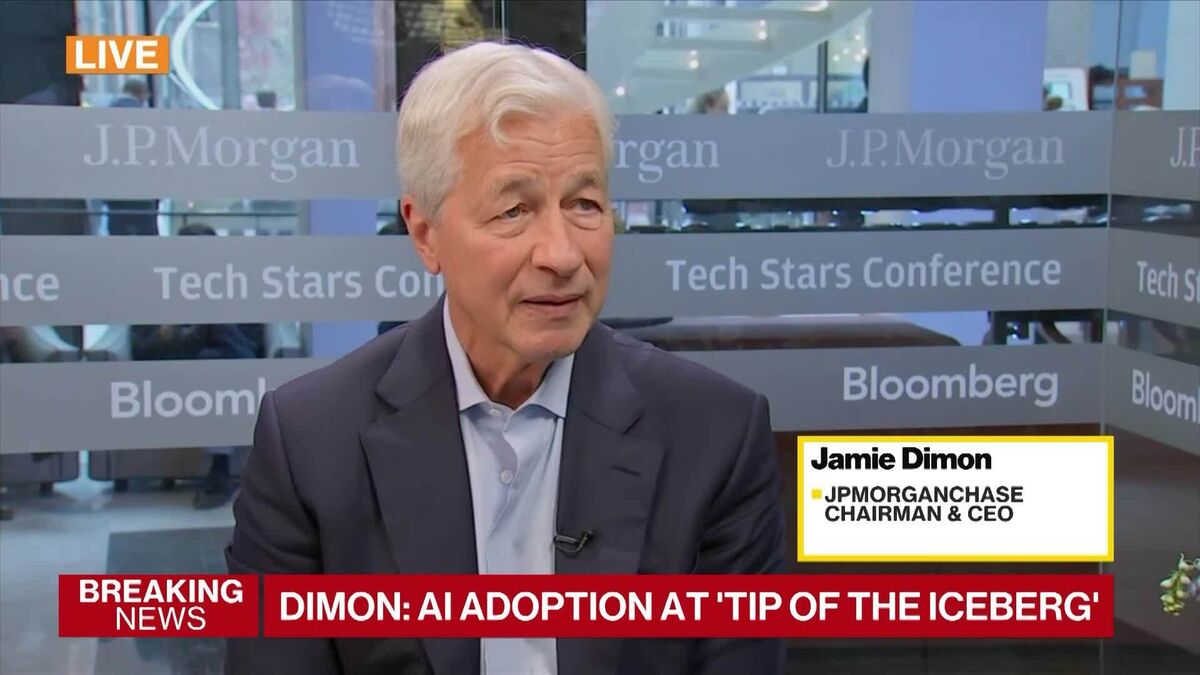

JPMorgan’s Manhattan Tower Anchors a Multi-Block Campus

PositiveFinancial Markets

JPMorgan Chase & Co. is set to unveil its impressive new megatower in Midtown Manhattan later this month, marking a significant expansion with nearly 6 million square feet of office space. This development not only showcases the bank's commitment to growth but also revitalizes the area, creating a modern campus that could attract more businesses and talent to the city.

— Curated by the World Pulse Now AI Editorial System