Polymarket CEO Becomes Youngest Self-Made Billionaire

PositiveFinancial Markets

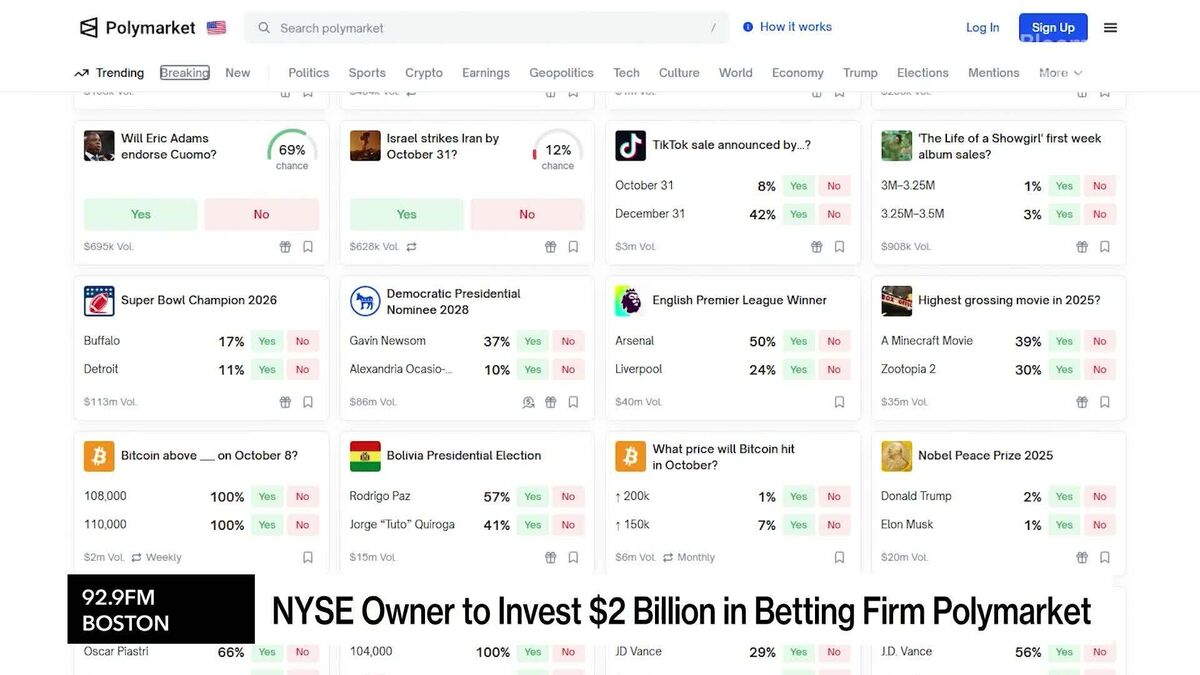

Shayne Coplan, the 27-year-old founder of Polymarket, has made headlines as the youngest self-made billionaire according to the Bloomberg Billionaires Index. His journey from struggling to pay rent after dropping out of New York University to achieving this remarkable milestone highlights the potential of the crypto industry. With Intercontinental Exchange Inc. planning to invest up to $2 billion in Polymarket, this news not only marks a personal triumph for Coplan but also signifies growing confidence in innovative financial platforms.

— Curated by the World Pulse Now AI Editorial System