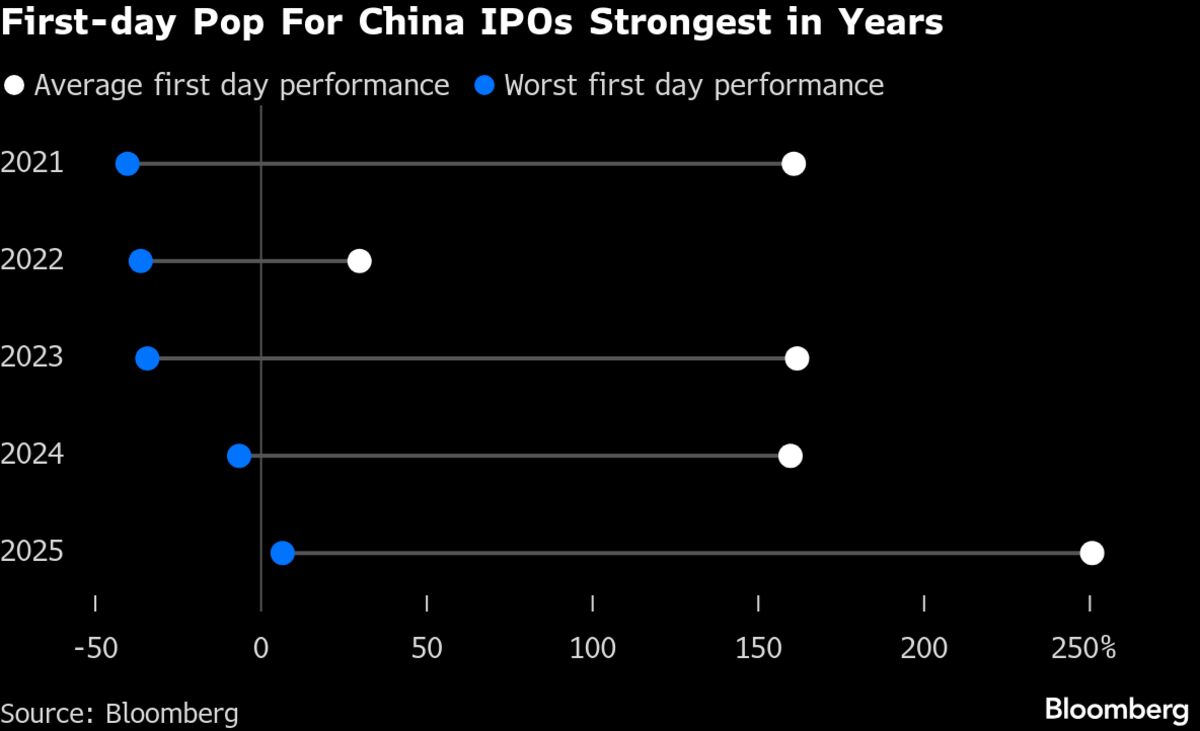

Only 0.02% of Stock Bids Are Awarded in China IPO Market Frenzy

NegativeFinancial Markets

- In the current frenzy of China's IPO market, only 0.02% of stock bids are being awarded, making it increasingly difficult for investors to secure shares in new listings. This situation reflects a significant shift in market dynamics, where demand far exceeds supply, leaving many investors frustrated and disillusioned.

- The low allocation rate in IPOs highlights the challenges faced by investors in the Chinese market, which has seen a surge in interest despite the difficulties in obtaining shares. This trend may deter potential investors and impact the overall perception of the IPO landscape in China.

- While the Chinese IPO market struggles with allocation issues, there is a contrasting trend in the U.S., where the IPO market is gaining momentum with increased activity and optimism among bankers. This divergence illustrates the varying conditions and investor sentiments in global markets, as some regions experience growth while others face significant hurdles.

— via World Pulse Now AI Editorial System