Bankers Readying US IPOs at ‘Overwhelming’ Going Into 2026

PositiveFinancial Markets

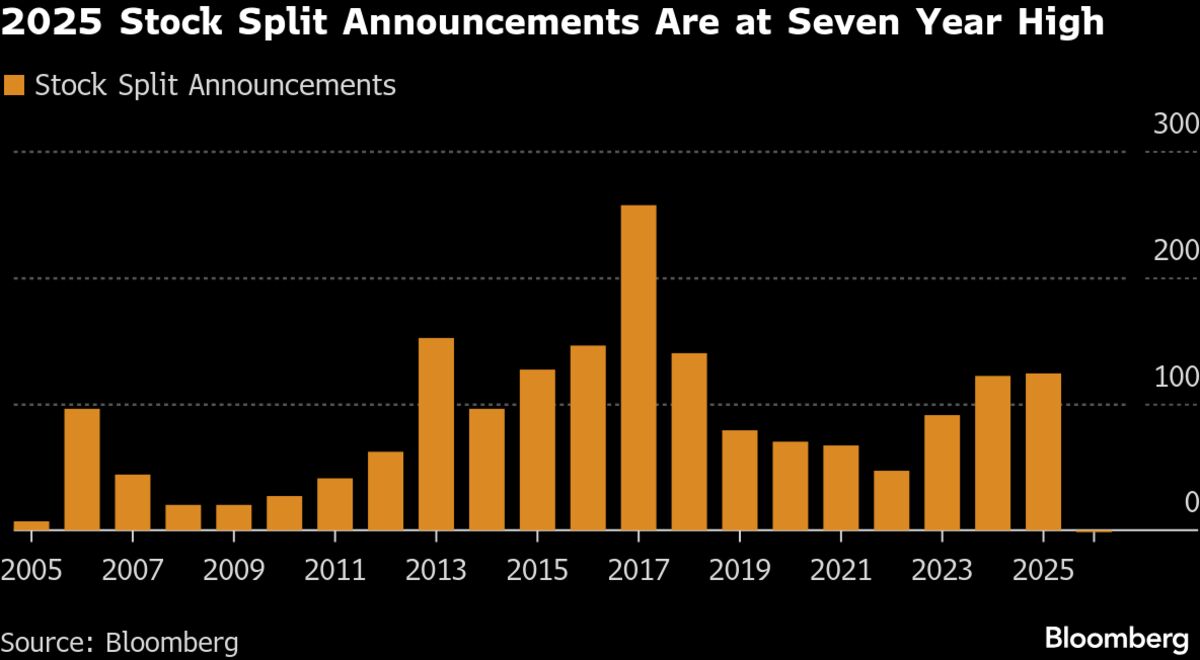

- The US IPO market is experiencing heightened activity as companies prepare to go public, driven by stock markets nearing record highs. Dealmaker optimism is growing as firms that postponed their listings due to the US government shutdown are now lining up underwriting mandates, with expectations that 2026 could be a significant year for IPOs, particularly for major private tech companies.

- This surge in IPO preparations is crucial for companies looking to capitalize on favorable market conditions and investor sentiment. The anticipated influx of new listings could provide a much-needed boost to the market, enhancing liquidity and investor engagement in the coming years.

- The broader financial landscape is showing signs of recovery, with Wall Street analysts predicting rebounds in various markets, including India, and bankers expressing confidence in mergers and acquisitions. This optimism reflects a potential shift in market dynamics as firms navigate recent fluctuations and prepare for a more robust investment environment.

— via World Pulse Now AI Editorial System