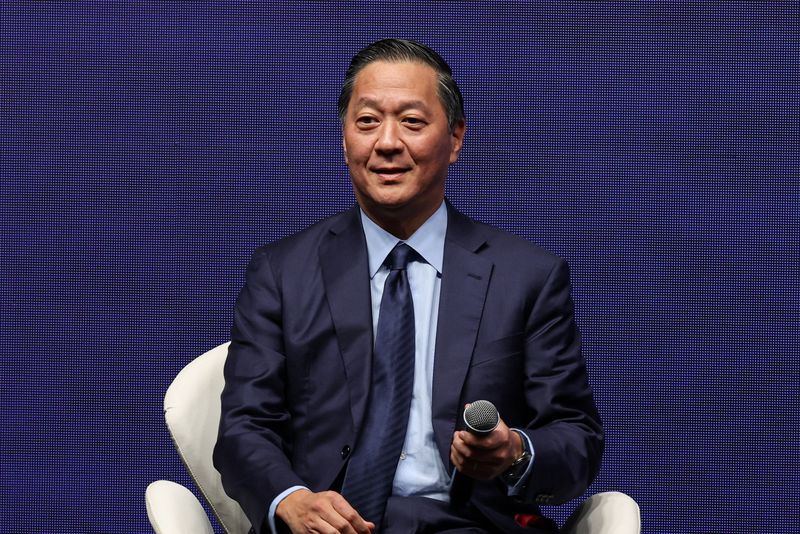

First Brands accuses former CEO Patrick James of multibillion-dollar fraud

NegativeFinancial Markets

First Brands has made serious allegations against its former CEO, Patrick James, accusing him of orchestrating a multibillion-dollar fraud. This situation raises significant concerns about corporate governance and accountability, as it highlights the potential risks companies face from within. The outcome of this case could have far-reaching implications for investors and the industry as a whole.

— Curated by the World Pulse Now AI Editorial System