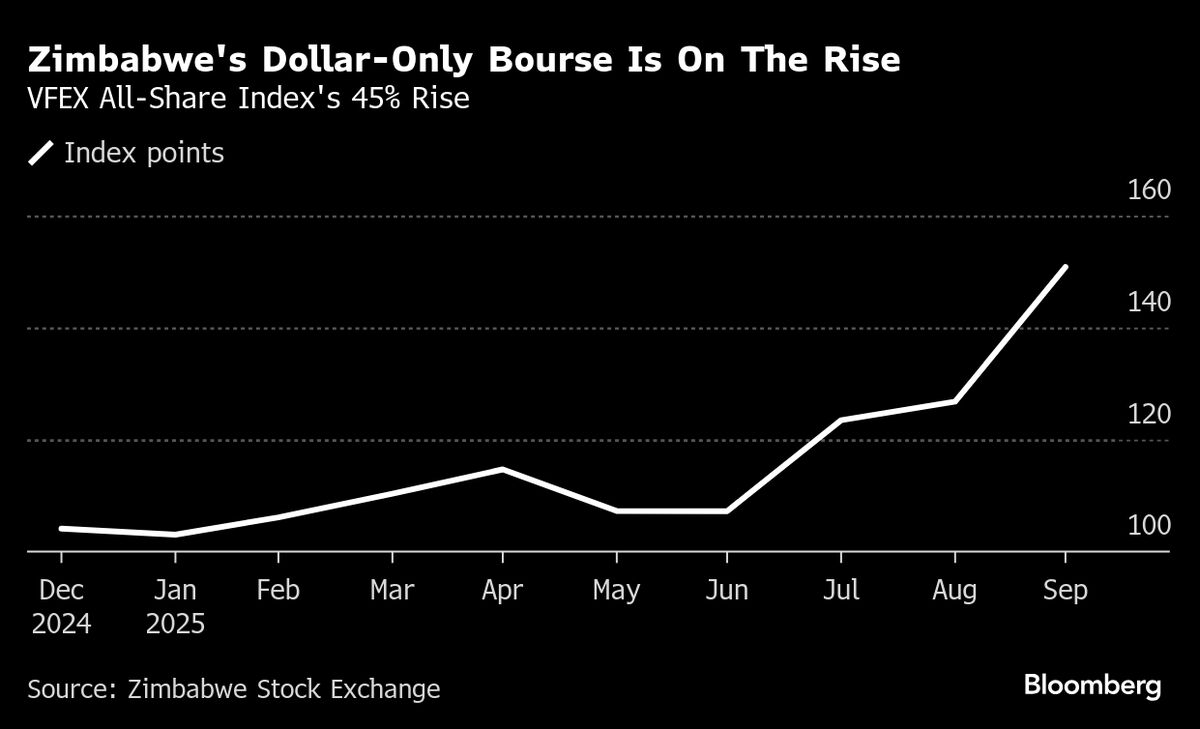

Gold Rally, ZiG Crunch Spurs 45% Jump on Zimbabwe’s Dollar Bourse

PositiveFinancial Markets

Zimbabwe's dollar-only stock market is experiencing a significant surge, with a remarkable 45% increase driven by gold miners benefiting from a 48% rise in gold prices this year. This rally not only highlights the resilience of the local economy but also showcases the potential for investment opportunities in the region, making it an exciting time for investors and stakeholders alike.

— Curated by the World Pulse Now AI Editorial System