Oil price rises after Opec+ pauses oil output hikes amid glut fears – business live

PositiveFinancial Markets

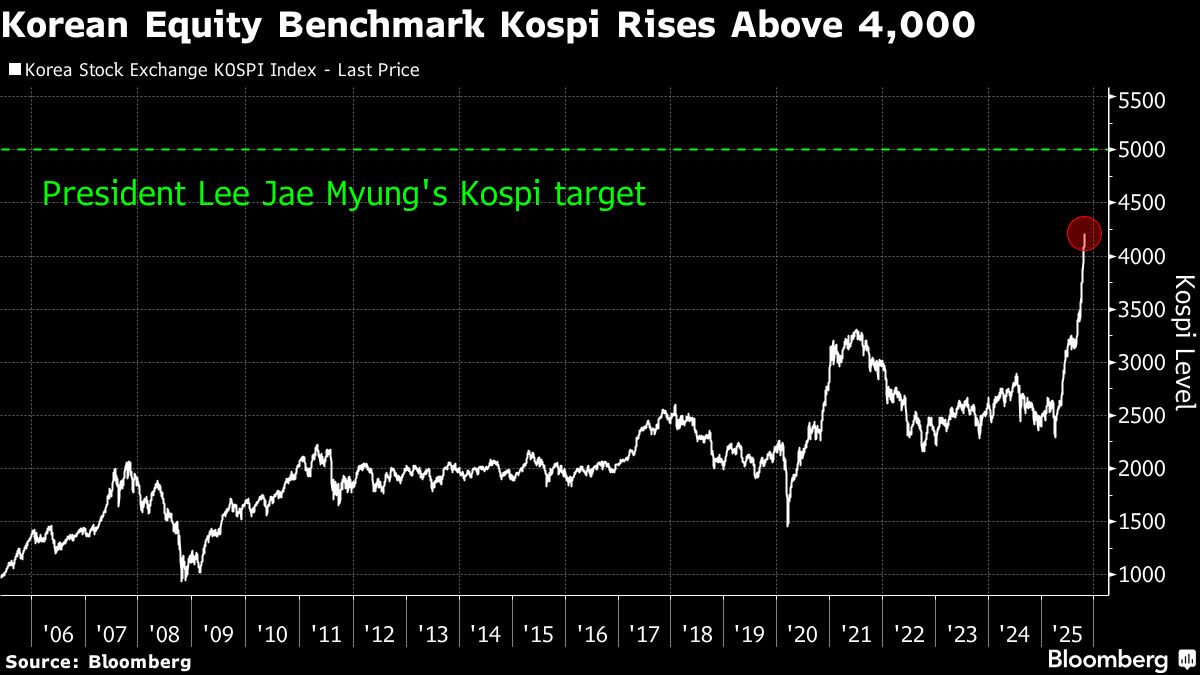

Oil prices are on the rise as Opec+ has decided to pause any further output hikes beyond December, addressing concerns about a potential crude glut. This decision comes at a time when Asia-Pacific stock markets are experiencing a boost, largely due to positive sentiments surrounding the recent US-China trade deal. With indices like China's CSI 300 and South Korea's KOSPI 200 showing significant gains, this news is crucial as it reflects a stabilizing economic environment and could lead to increased investor confidence.

— Curated by the World Pulse Now AI Editorial System