US bank stocks plunge as investors grow uneasy about mounting risks

NegativeFinancial Markets

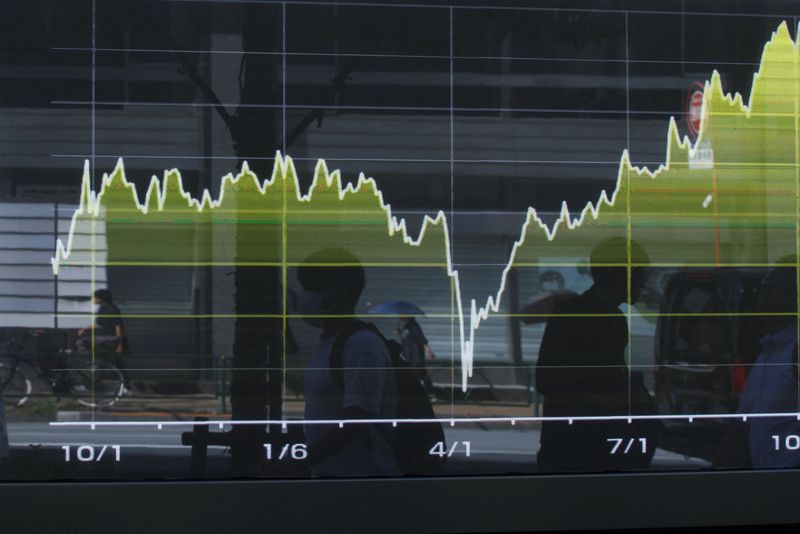

US bank stocks have taken a significant hit as investors express growing concerns over increasing risks in the financial sector. This decline reflects broader anxieties about economic stability and the potential for future downturns, making it a critical moment for both investors and the banking industry. Understanding these trends is essential for anyone keeping an eye on the market.

— Curated by the World Pulse Now AI Editorial System