Why Investors Can’t Seem to Get Enough of Gold

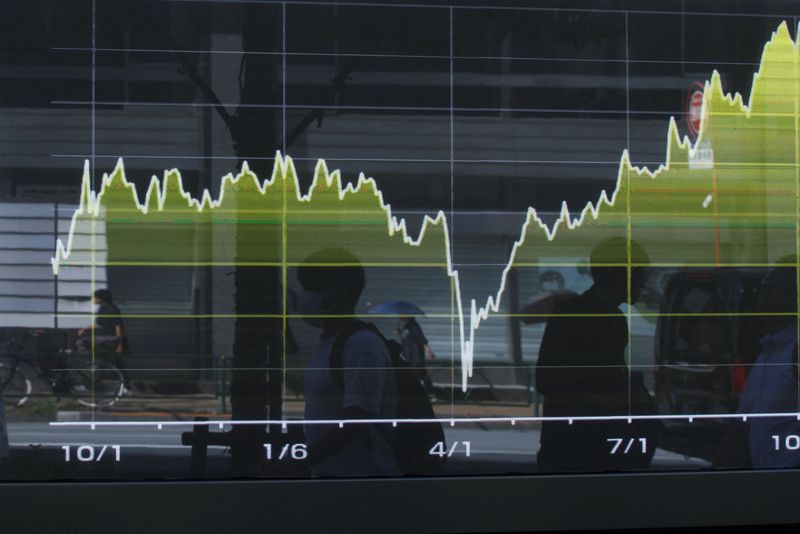

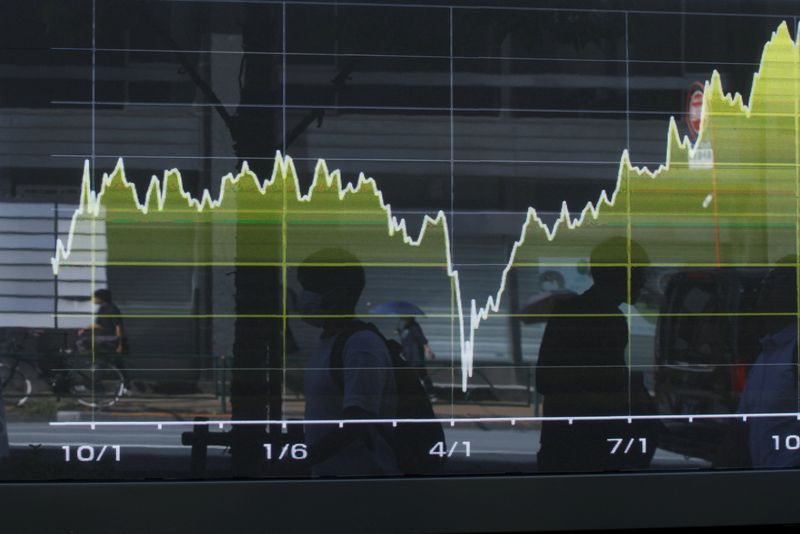

PositiveFinancial Markets

Investors are increasingly turning to gold as a safe haven during times of political and economic uncertainty. This trend highlights gold's enduring appeal as a high-value commodity that can be easily transported and sold globally, providing a sense of security when other investments may falter. Understanding this shift is crucial for anyone looking to navigate the current financial landscape.

— Curated by the World Pulse Now AI Editorial System