Why Investors Can't Seem to Get Enough of Gold

PositiveFinancial Markets

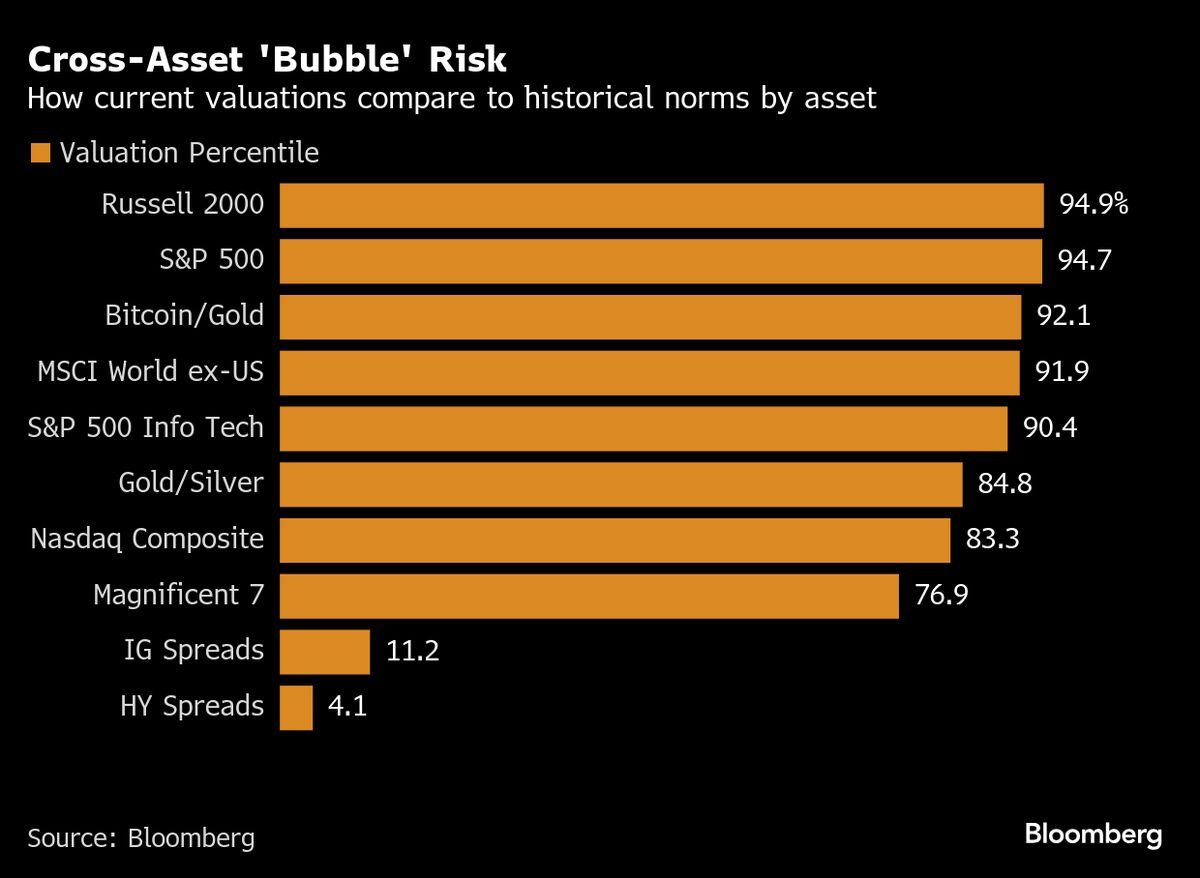

Gold prices have been hitting record highs recently, attracting a wave of investors seeking safe havens amid economic uncertainty. This surge is significant as it reflects growing concerns about market stability, prompting many to turn to gold as a reliable asset. Understanding the factors behind this trend can help investors make informed decisions in a volatile market.

— Curated by the World Pulse Now AI Editorial System