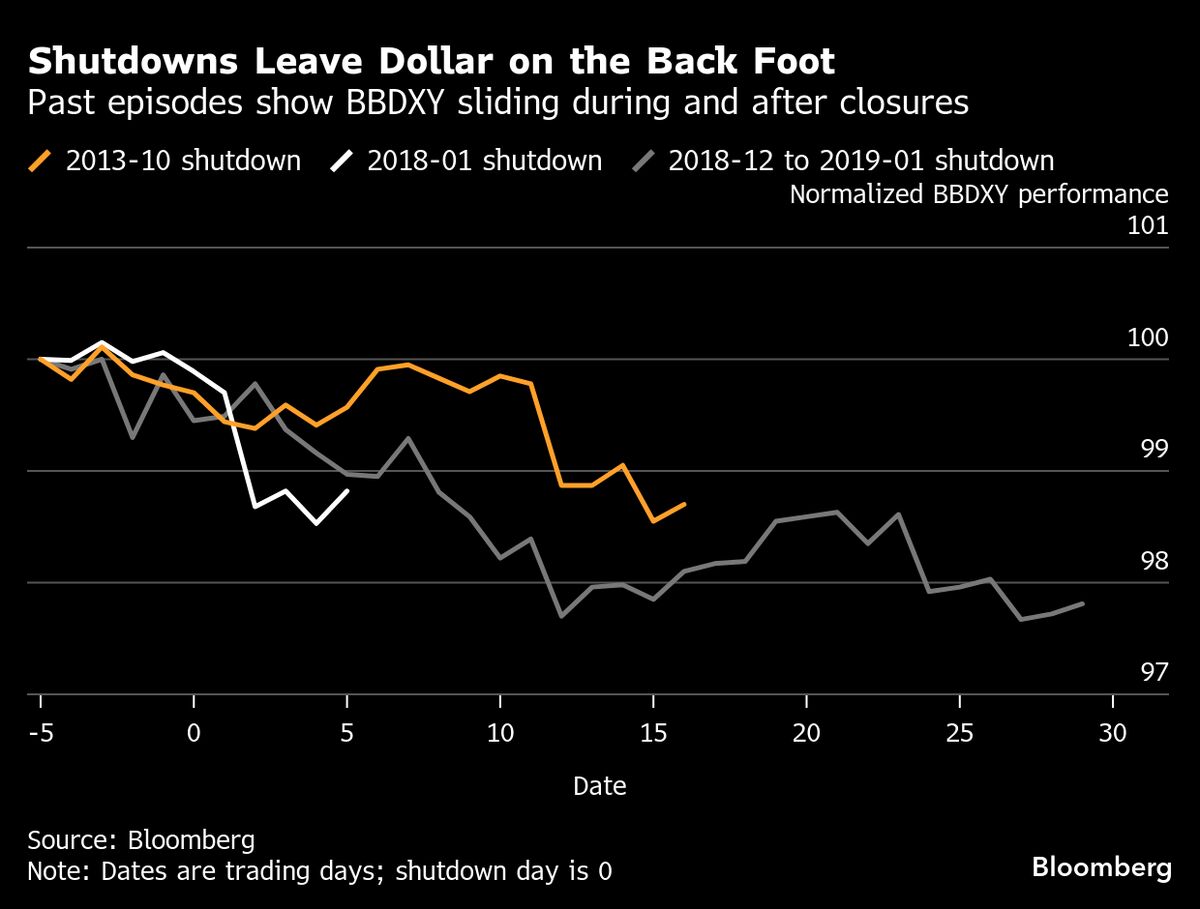

What a US Government Shutdown Means for Markets

NeutralFinancial Markets

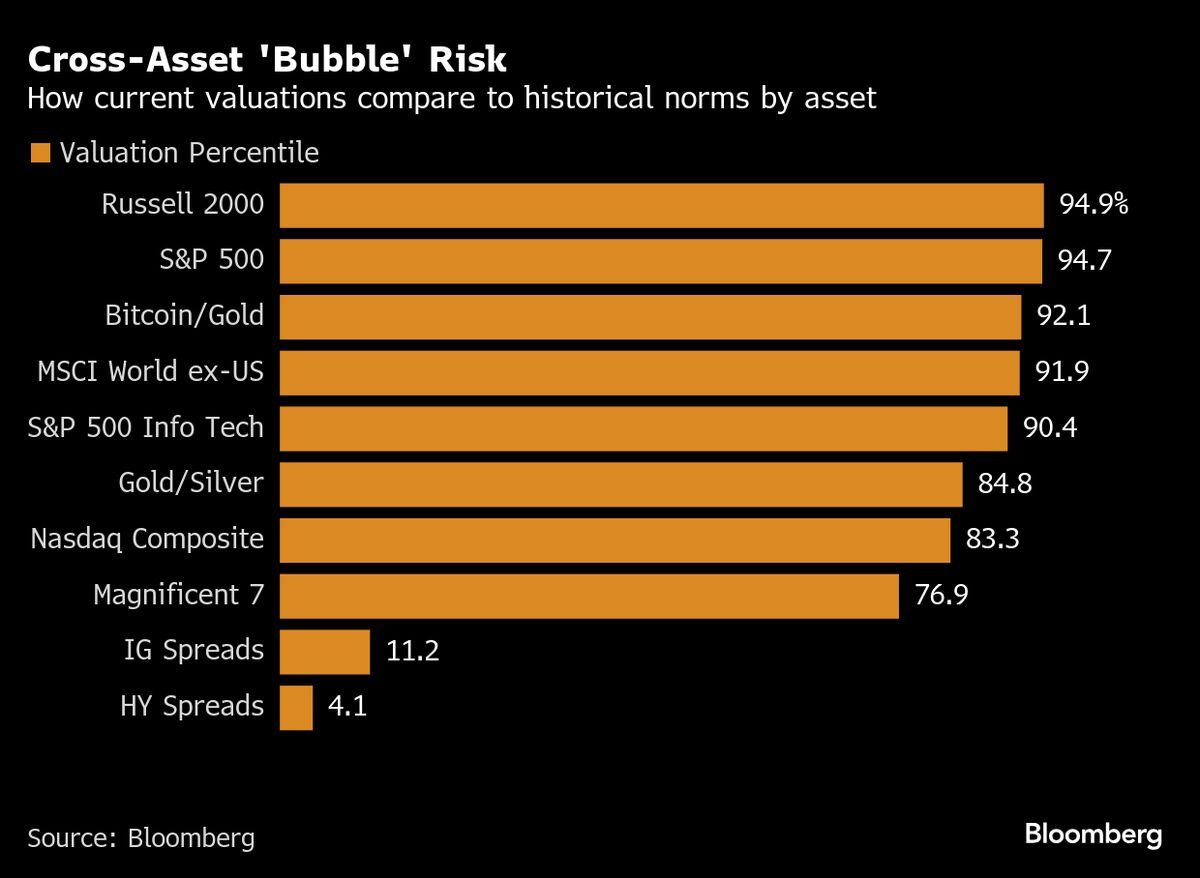

The potential US government shutdown is stirring up discussions in financial markets, as it could lead to a rally in gold prices, increased pressure on the dollar, and gains for Treasuries. Understanding these dynamics is crucial for investors, as they navigate the uncertainties that a shutdown brings to the economy.

— Curated by the World Pulse Now AI Editorial System