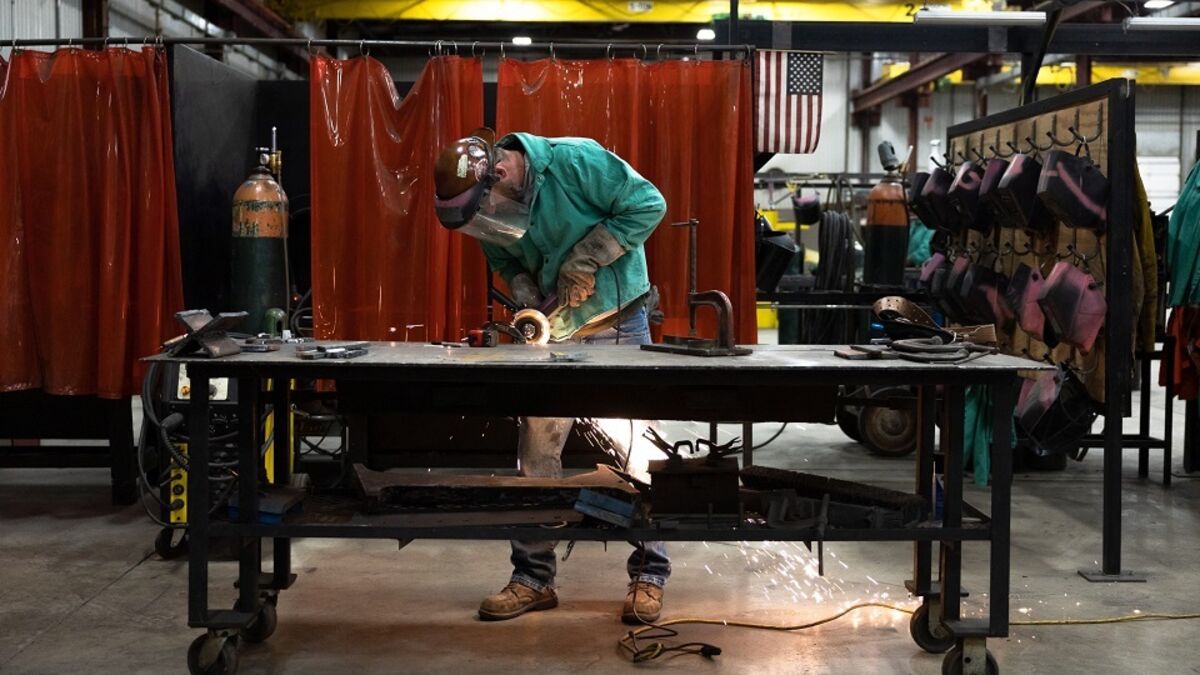

US Employers Scale Back Hiring, Job Cut Announcements

NegativeFinancial Markets

In September, US employers significantly reduced their hiring plans, announcing only 117,313 new jobs, which is a staggering 71% drop compared to the same month last year. This marks the weakest September for hiring intentions since 2011, raising concerns about the job market's health and the broader economy. The decline in hiring could signal a slowdown in economic growth, affecting consumer confidence and spending.

— Curated by the World Pulse Now AI Editorial System