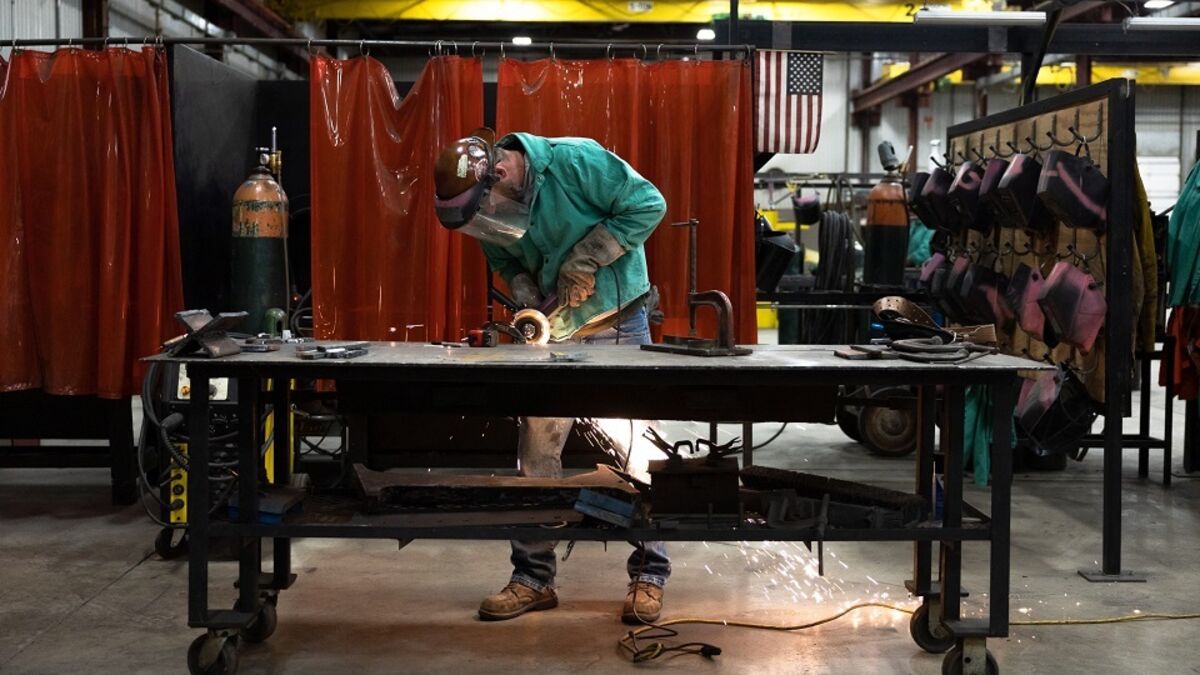

Oil May Be Answer to Data Center Power Demand, BofA Says

PositiveFinancial Markets

In a recent interview, Francisco Blanch from Bank of America highlighted the potential role of oil in meeting the soaring power demands of artificial intelligence data centers. With electricity prices hitting record highs, he suggests that oil, which currently accounts for about a third of our energy consumption, could see a resurgence if prices remain low. This insight is significant as it opens up discussions on energy diversification and the future of power generation in the tech industry.

— Curated by the World Pulse Now AI Editorial System