Business Daily

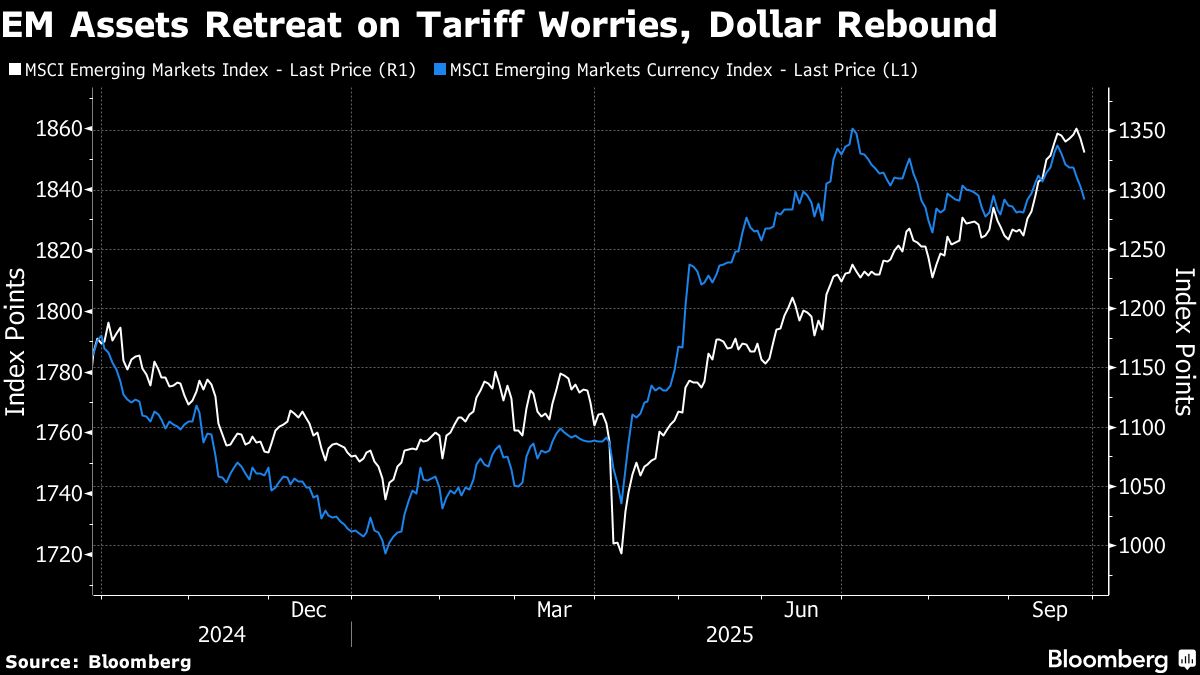

NegativeFinancial Markets

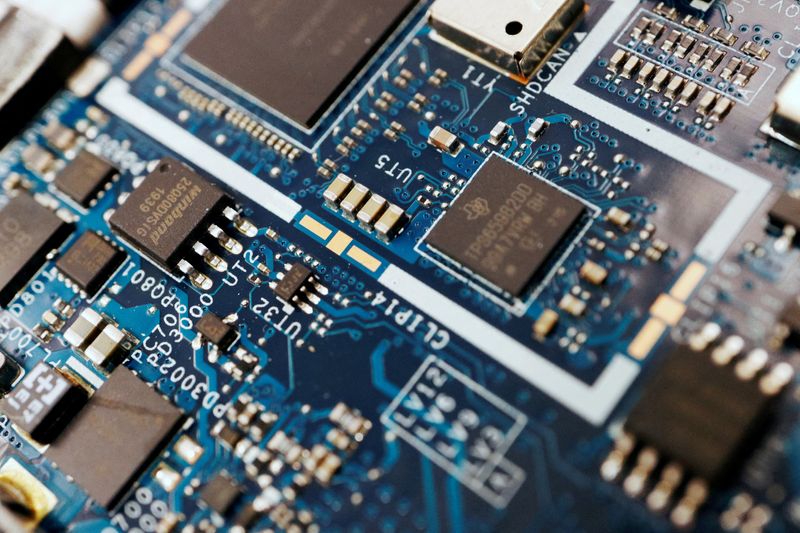

In the US, rising prices are causing concern as supply struggles to meet increasing demand. This situation highlights the challenges businesses face in maintaining balance in the market, which can lead to economic instability. Understanding these dynamics is crucial for consumers and policymakers alike.

— Curated by the World Pulse Now AI Editorial System

3_M_1440049439.jpg)