Emerging Assets Post Worst Week in Two Months on Fed, Tariffs

NegativeFinancial Markets

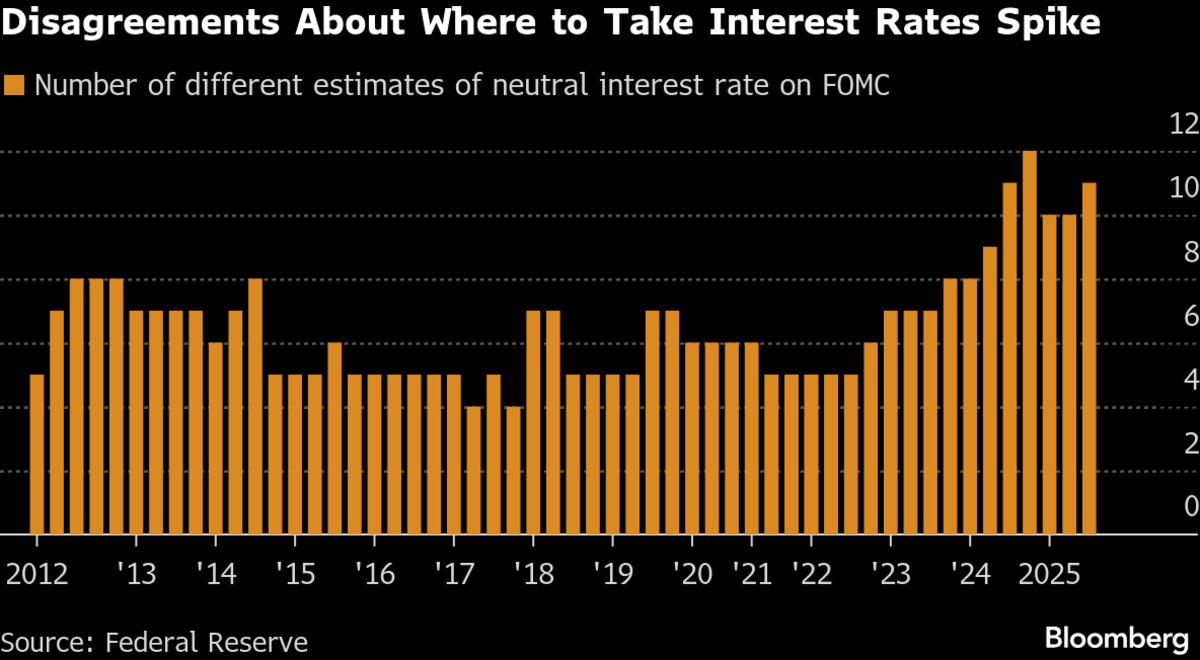

Emerging-market currencies and stocks have faced a tough week, marking their worst performance since early August. This decline comes as traders react to the Federal Reserve's uncertain stance on interest rate cuts and the latest tariffs imposed by President Donald Trump. The situation is significant as it reflects broader economic concerns and could impact global trade and investment strategies.

— via World Pulse Now AI Editorial System