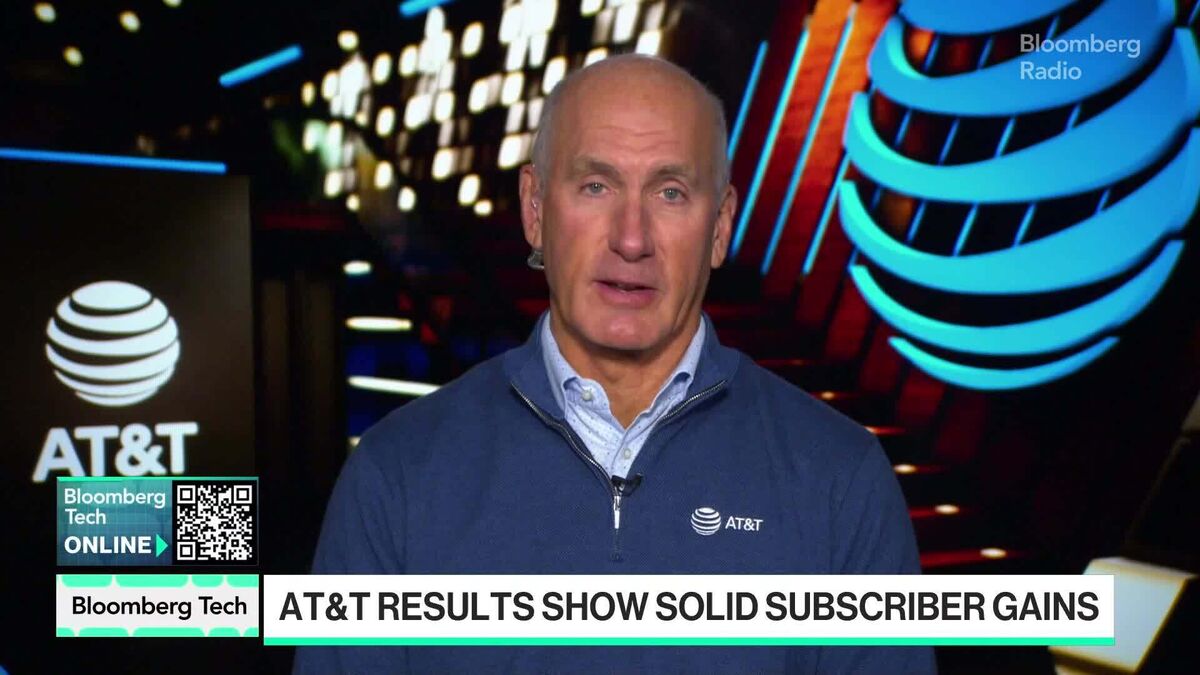

AT&T Broadband Gains Were Best in Eight Years, Says CEO

PositiveFinancial Markets

AT&T is celebrating its best broadband subscriber growth in eight years, as CEO John Stankey highlights the company's strategic push through advertising and bundling. This surge is partly fueled by the recent iPhone 17 release and the anticipation of increased demand during the holiday season. Such growth not only reflects AT&T's successful marketing efforts but also positions the company favorably in a competitive market, making it an exciting time for both the company and its customers.

— Curated by the World Pulse Now AI Editorial System