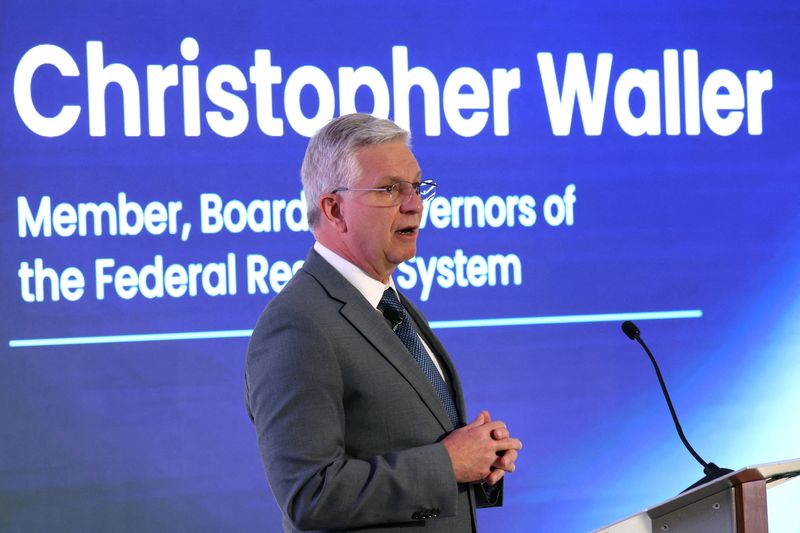

Fed's Waller on board for an October rate cut, as Miran again presses for aggressive easing

PositiveFinancial Markets

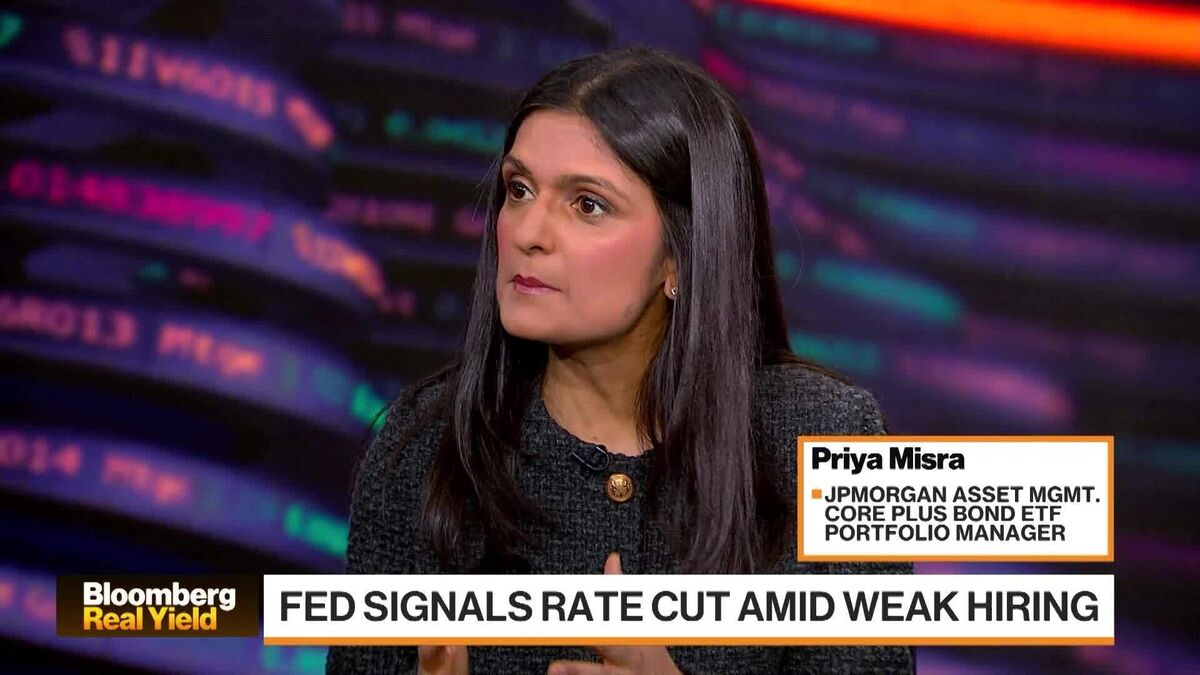

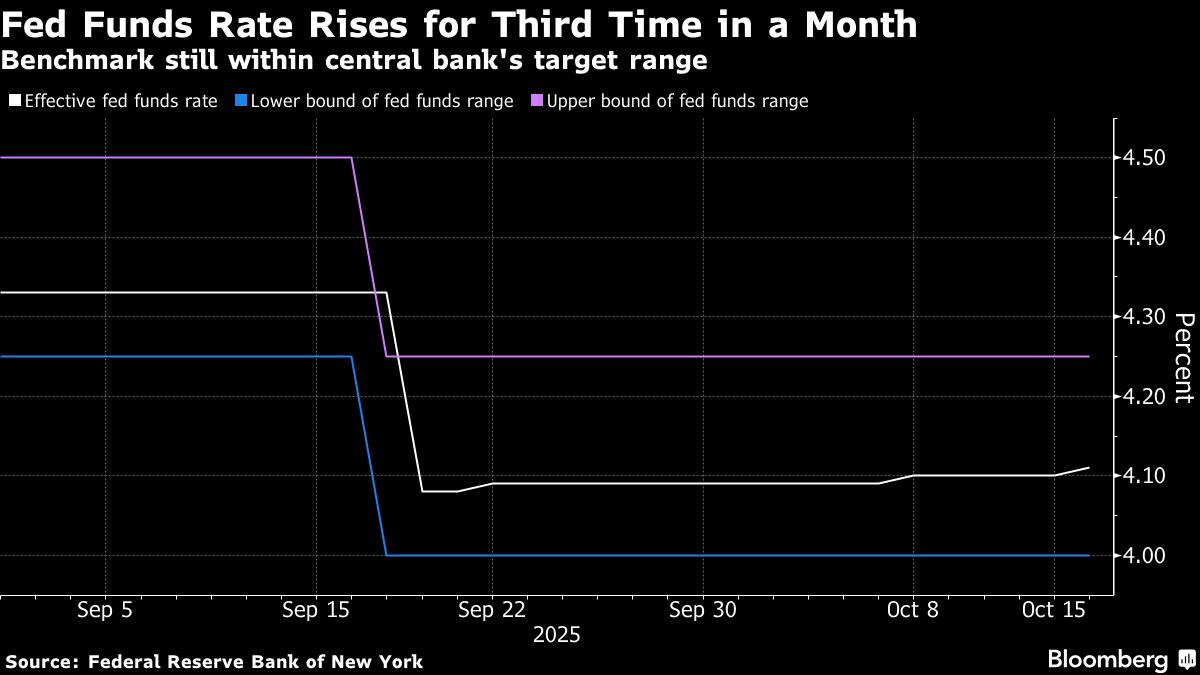

Federal Reserve Governor Christopher Waller has expressed support for a potential interest rate cut in October, aligning with calls from economist Miran for more aggressive monetary easing. This development is significant as it indicates a shift in the Fed's approach to managing inflation and economic growth, potentially providing relief to borrowers and stimulating spending.

— Curated by the World Pulse Now AI Editorial System