CalPERS Explains ‘No’ Vote for Musk’s $1 Trillion Pay Deal

NegativeFinancial Markets

CalPERS Explains ‘No’ Vote for Musk’s $1 Trillion Pay Deal

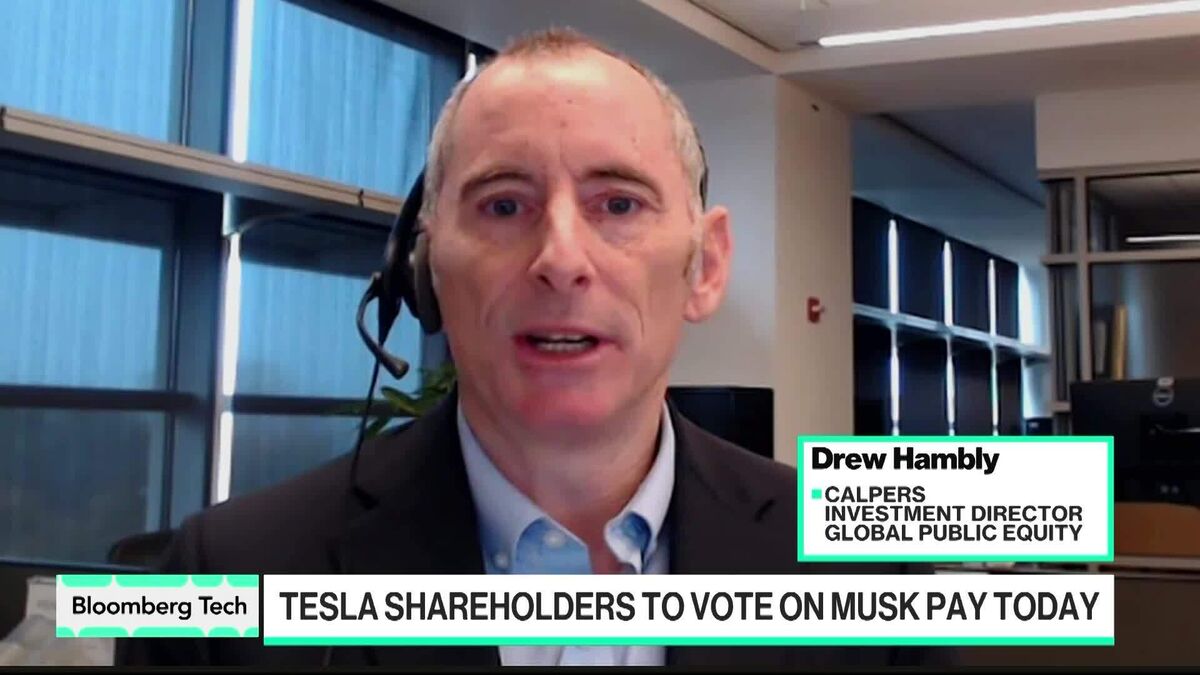

CalPERS, the largest public pension fund in the U.S., has voted against Elon Musk's proposed $1 trillion pay package for Tesla. Drew Hambly, the investment director at CalPERS, explained the reasoning behind this decision during an appearance on Bloomberg Tech. This vote is significant as it reflects the concerns of major investors regarding executive compensation and its alignment with company performance, potentially influencing future corporate governance practices.

— via World Pulse Now AI Editorial System