Tesla Investors Back Musk’s Trillion Dollar Payday

PositiveFinancial Markets

Tesla Investors Back Musk’s Trillion Dollar Payday

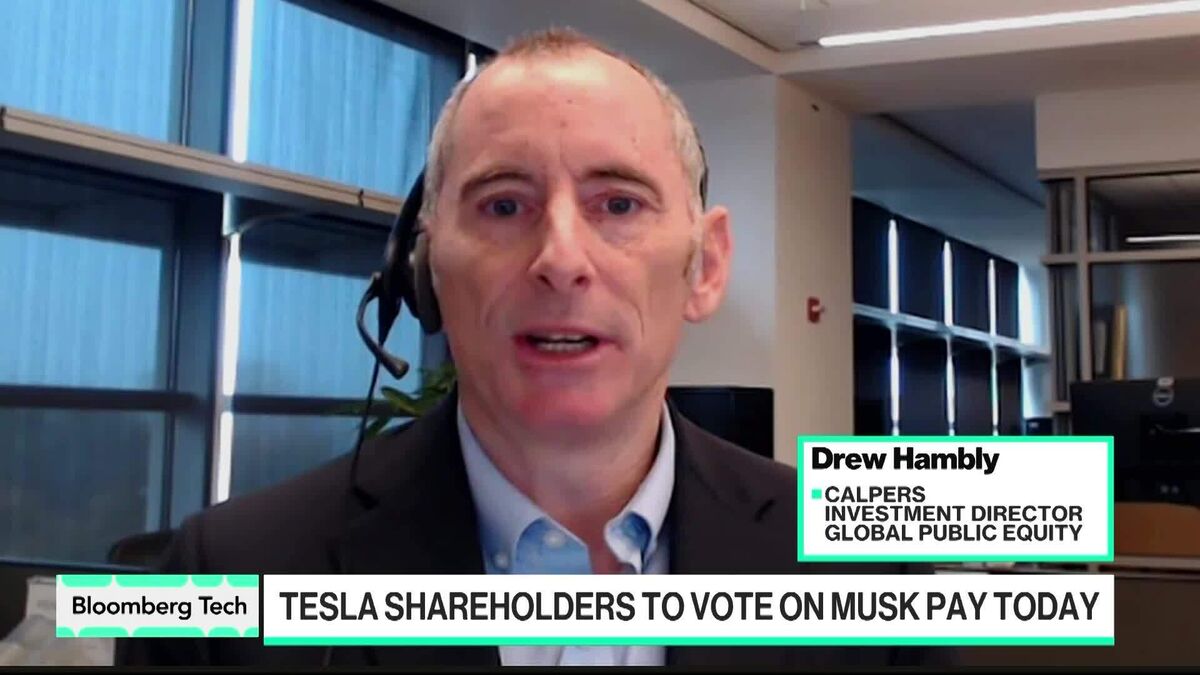

Tesla investors are rallying behind Elon Musk as he approaches a potential trillion-dollar payday, highlighting the company's remarkable growth and the confidence shareholders have in its future. This milestone not only underscores Musk's influence in the tech industry but also reflects the strong performance of Tesla's stock, which has surged due to innovative advancements and increasing demand for electric vehicles. As the market continues to evolve, this development is significant for both investors and the broader automotive sector.

— via World Pulse Now AI Editorial System