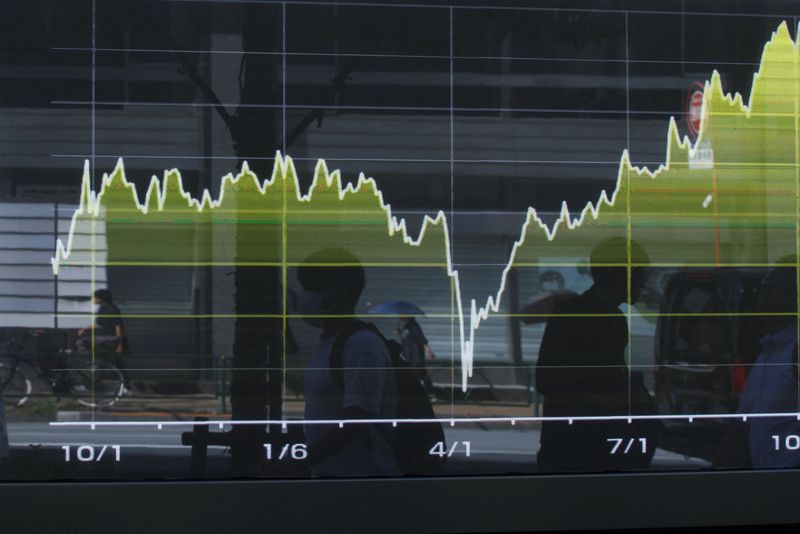

UK equities poised for growth after 2025 earnings bottom

PositiveFinancial Markets

UK equities are expected to see significant growth following a projected bottom in earnings by 2025. This is an encouraging sign for investors, as it suggests a potential recovery and increased profitability in the market. Understanding these trends is crucial for making informed investment decisions.

— Curated by the World Pulse Now AI Editorial System