Nike upgraded by KeyBanc as turnaround gains traction after Q1 beat

PositiveFinancial Markets

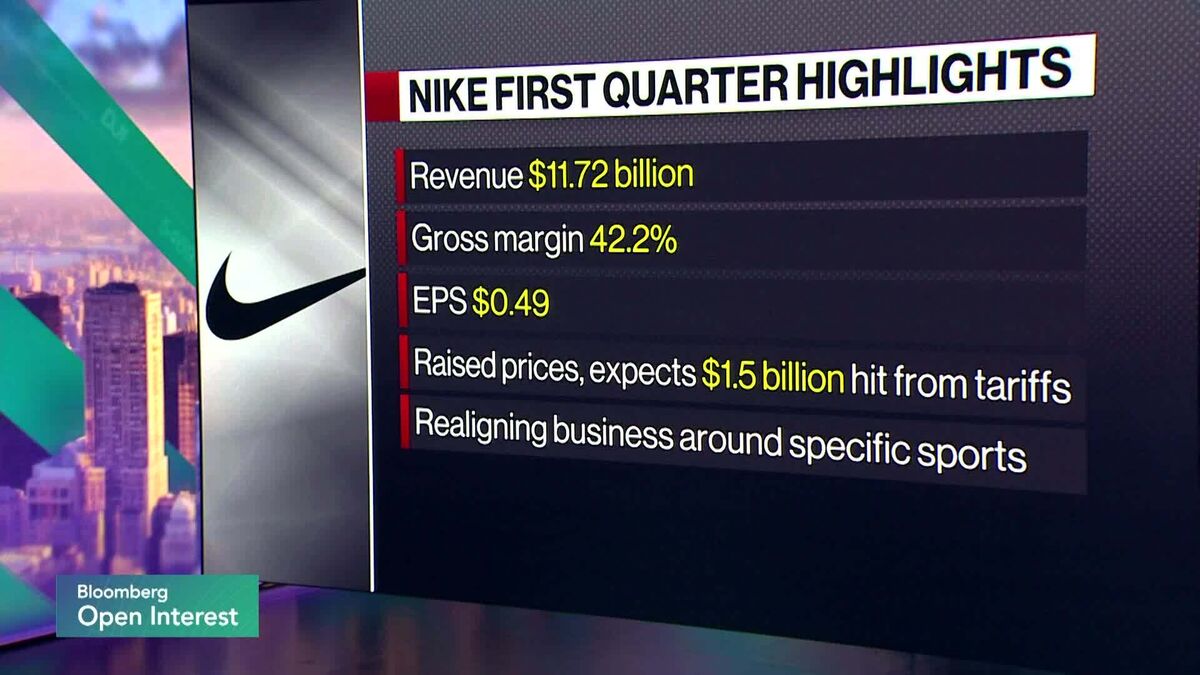

Nike has received an upgrade from KeyBanc following a strong performance in Q1, signaling that the company's turnaround strategy is gaining momentum. This positive news is significant as it reflects investor confidence in Nike's ability to rebound and adapt in a competitive market, potentially leading to increased sales and market share.

— Curated by the World Pulse Now AI Editorial System