Saudi Arabia signs ‘strategic mutual defence’ pact with Pakistan

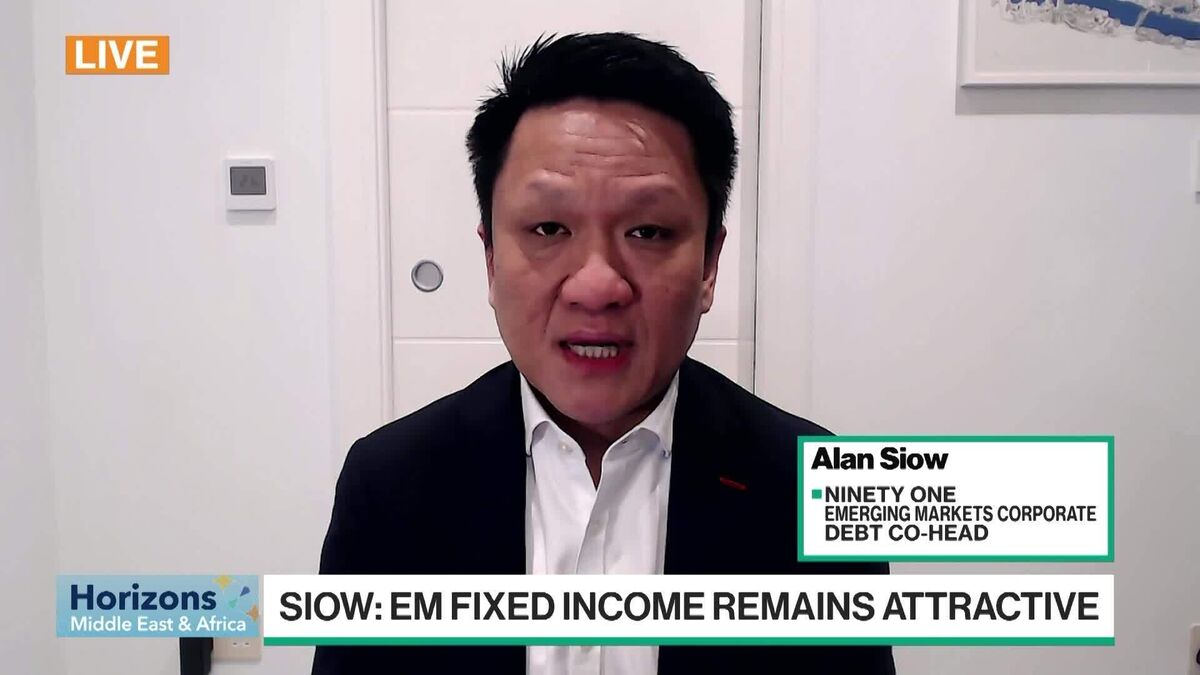

PositiveFinancial Markets

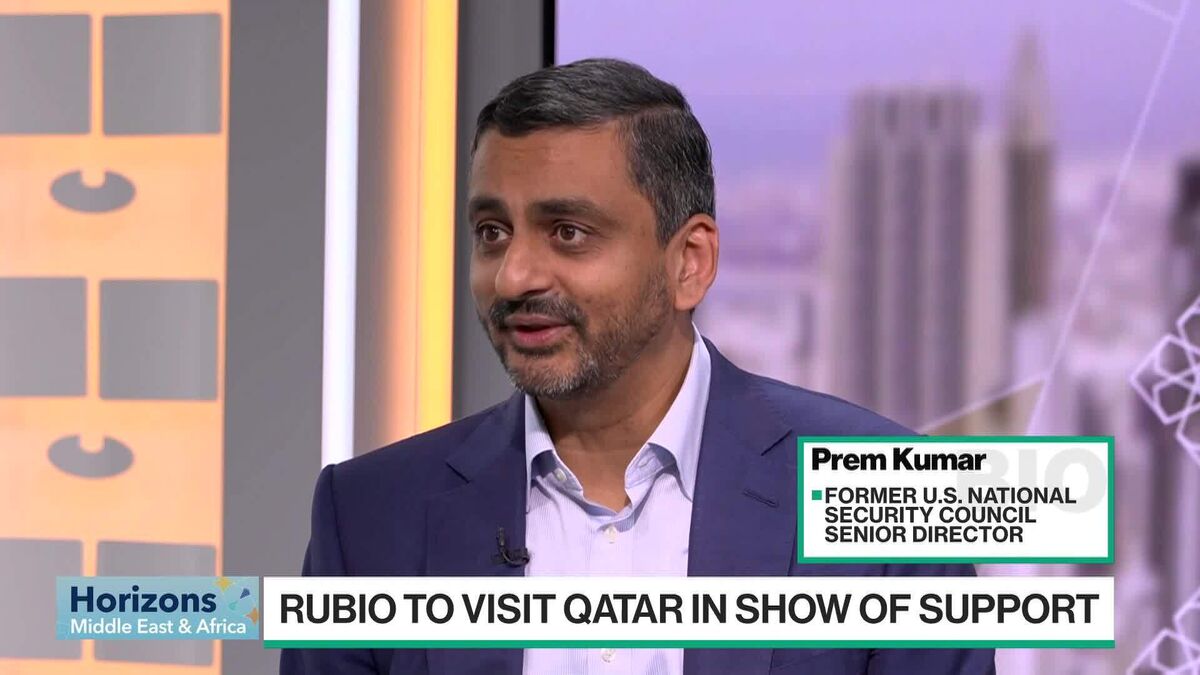

Saudi Arabia has signed a strategic mutual defense pact with Pakistan, marking a significant step in strengthening ties between the two nations. This agreement comes in the wake of heightened tensions in the Gulf region, particularly following the recent Israeli attack on Hamas leaders in Doha. The pact is important as it not only enhances military cooperation but also signals a united front among key players in the region, potentially stabilizing the geopolitical landscape.

— Curated by the World Pulse Now AI Editorial System