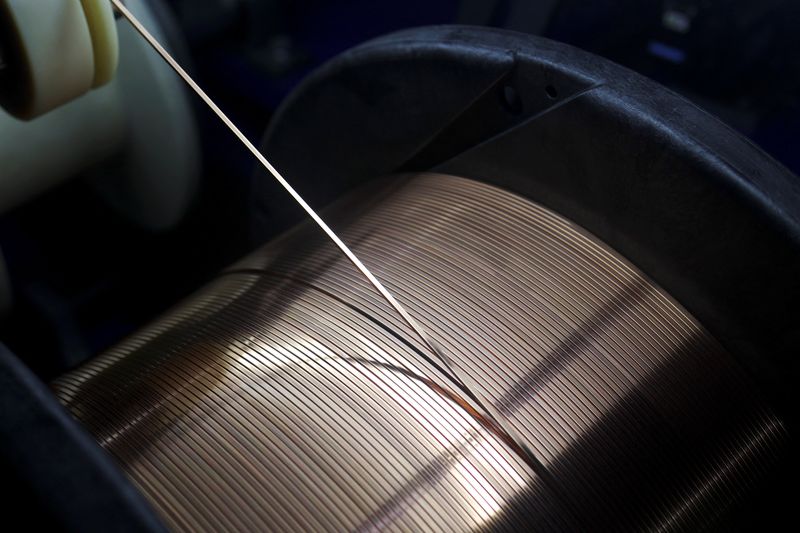

Aluminum Could Become the Next Copper

PositiveFinancial Markets

Aluminum is poised to become a key player in the market, potentially rivaling copper due to increasing demand driven by electrification. As industries shift towards more sustainable energy solutions, the need for aluminum is expected to rise. However, this surge in demand comes at a time when supply is limited, primarily due to escalating power requirements for production. This dynamic could reshape the metals market, making aluminum a critical resource for future technologies.

— Curated by the World Pulse Now AI Editorial System