Trump’s erratic policymaking frays nerves at multinational groups

NegativeFinancial Markets

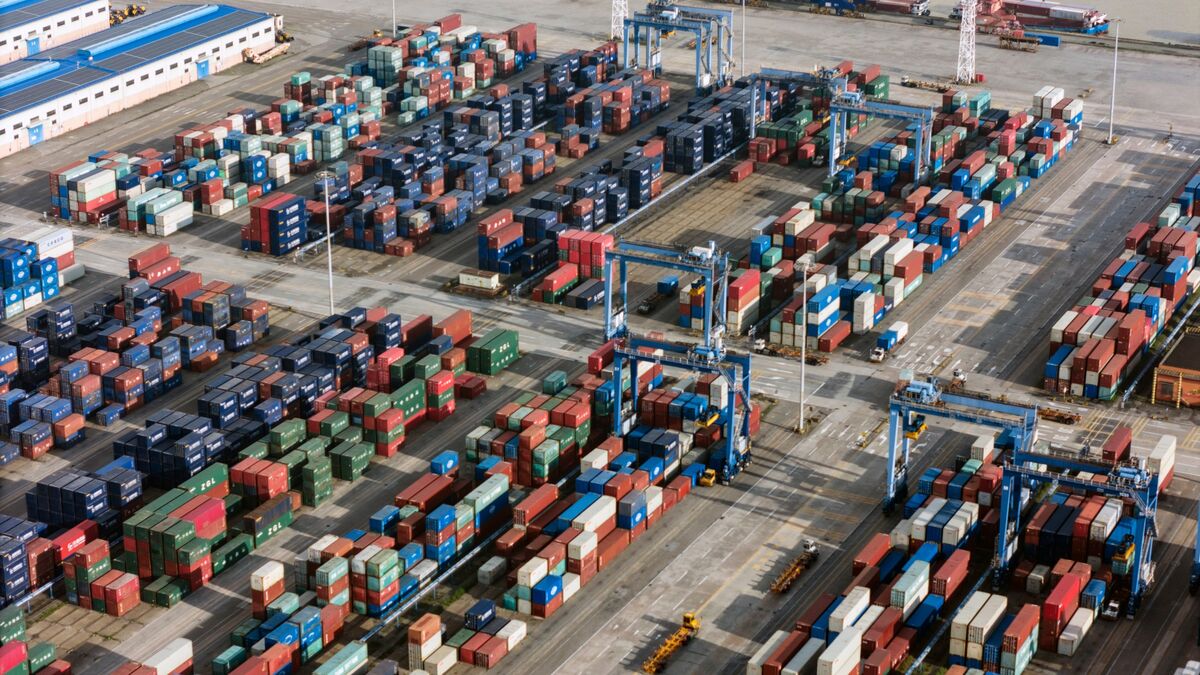

Recent developments in U.S. policymaking under Trump have raised concerns among multinational companies, prompting some to consider relocating staff or operations. This uncertainty can impact global business strategies and economic stability, making it crucial for companies to navigate these changes carefully.

— Curated by the World Pulse Now AI Editorial System