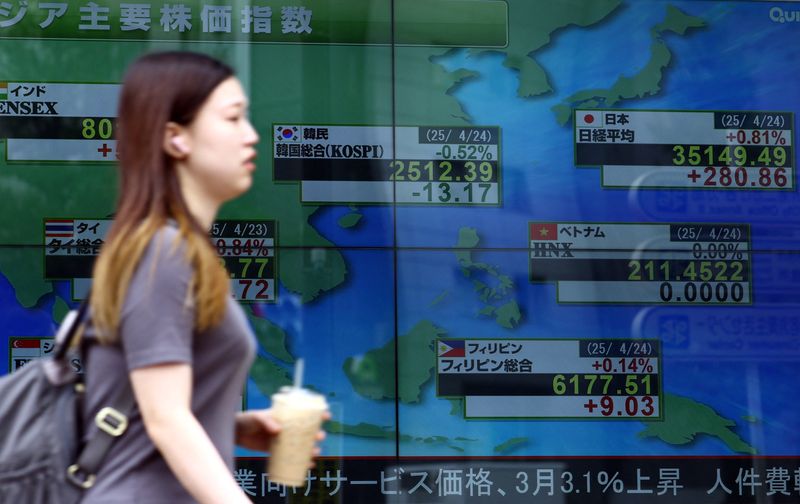

Stock Market Today: Dow Futures Rise; Dollar Falls as Government Shutdown Looms

NeutralFinancial Markets

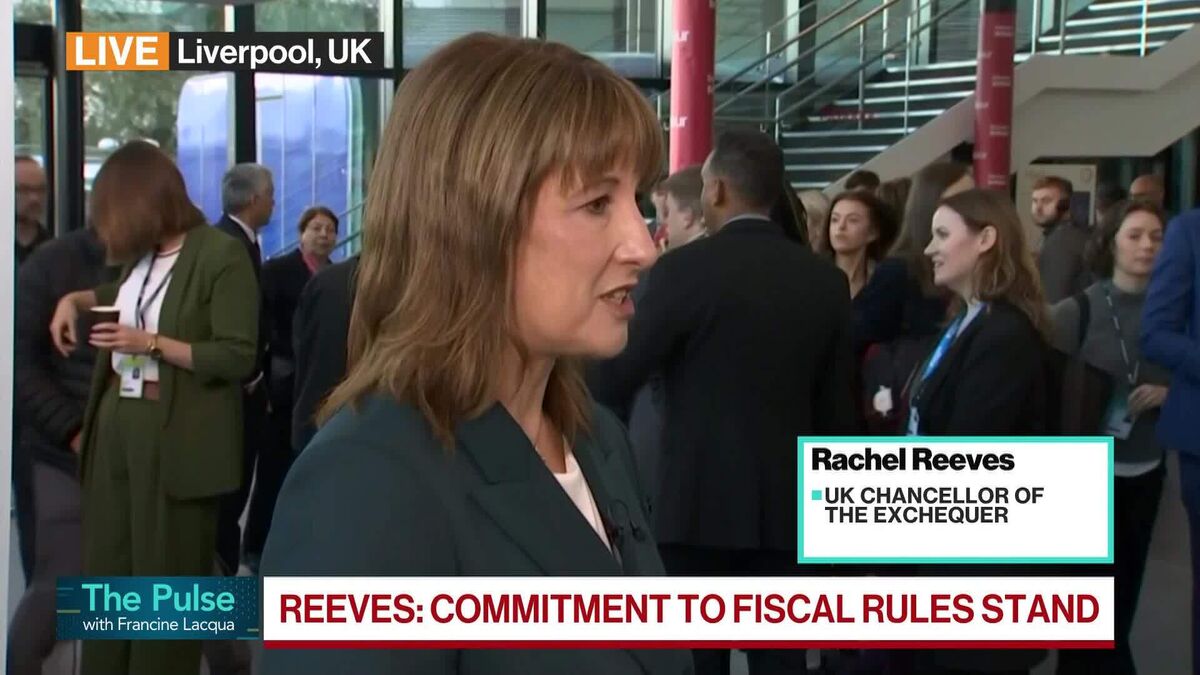

In today's financial news, Dow futures are on the rise while the dollar is experiencing a decline as concerns about a potential government shutdown loom. Former President Trump is scheduled to host urgent discussions with congressional leaders on Monday, which could influence market stability. This situation is significant as it reflects the ongoing political dynamics that can impact economic conditions and investor confidence.

— Curated by the World Pulse Now AI Editorial System