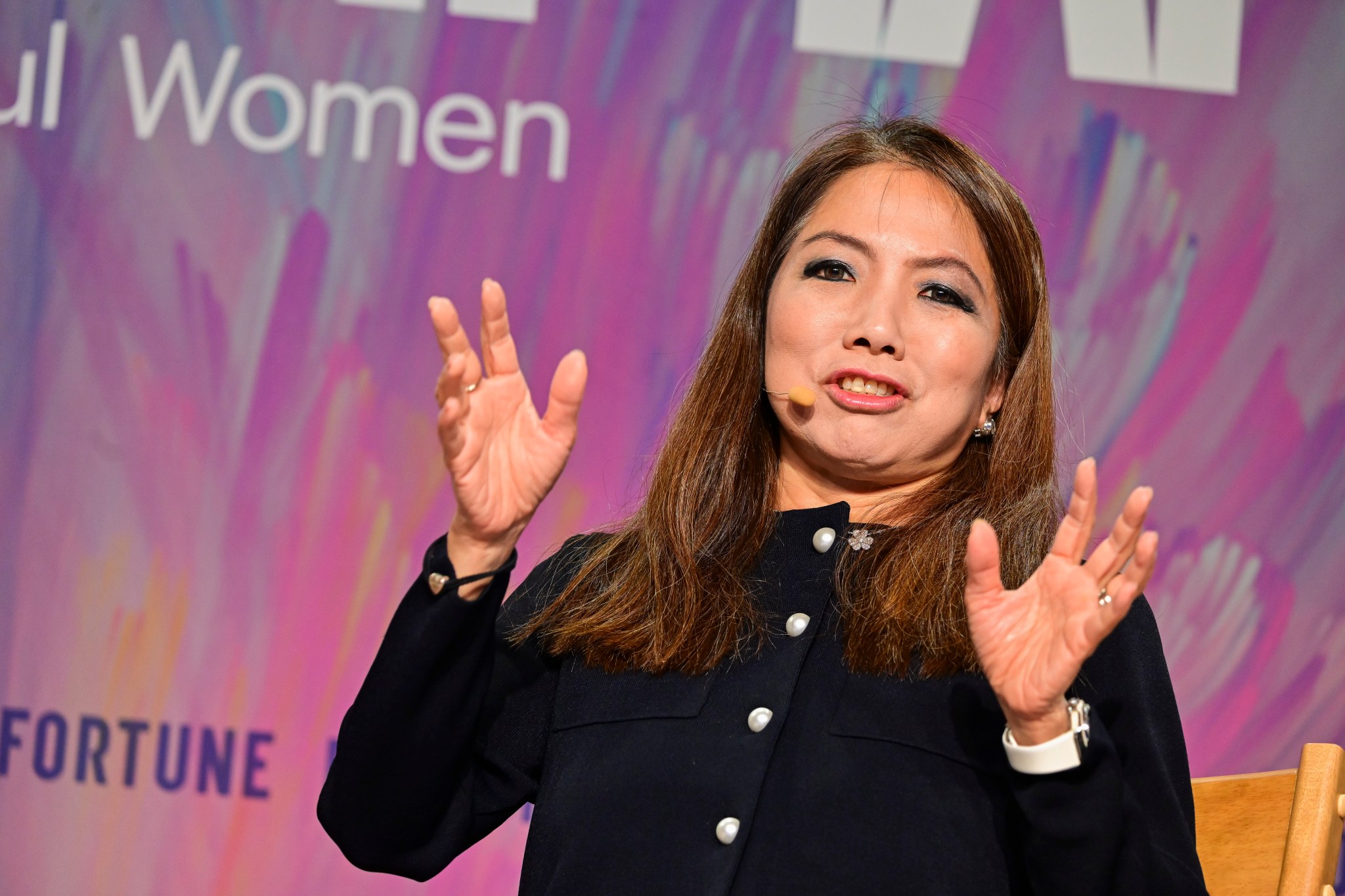

DBS CEO Tan Su Shan’s one big lesson for getting through Trump’s tariffs: ‘Diversify’

PositiveFinancial Markets

DBS CEO Tan Su Shan emphasizes the importance of diversification in navigating the challenges posed by Trump's tariffs. She notes that these tariffs are unexpectedly fostering collaboration among previously distant trading partners, highlighting a silver lining in a complex situation. This perspective is crucial for businesses looking to adapt and thrive in a changing economic landscape.

— Curated by the World Pulse Now AI Editorial System