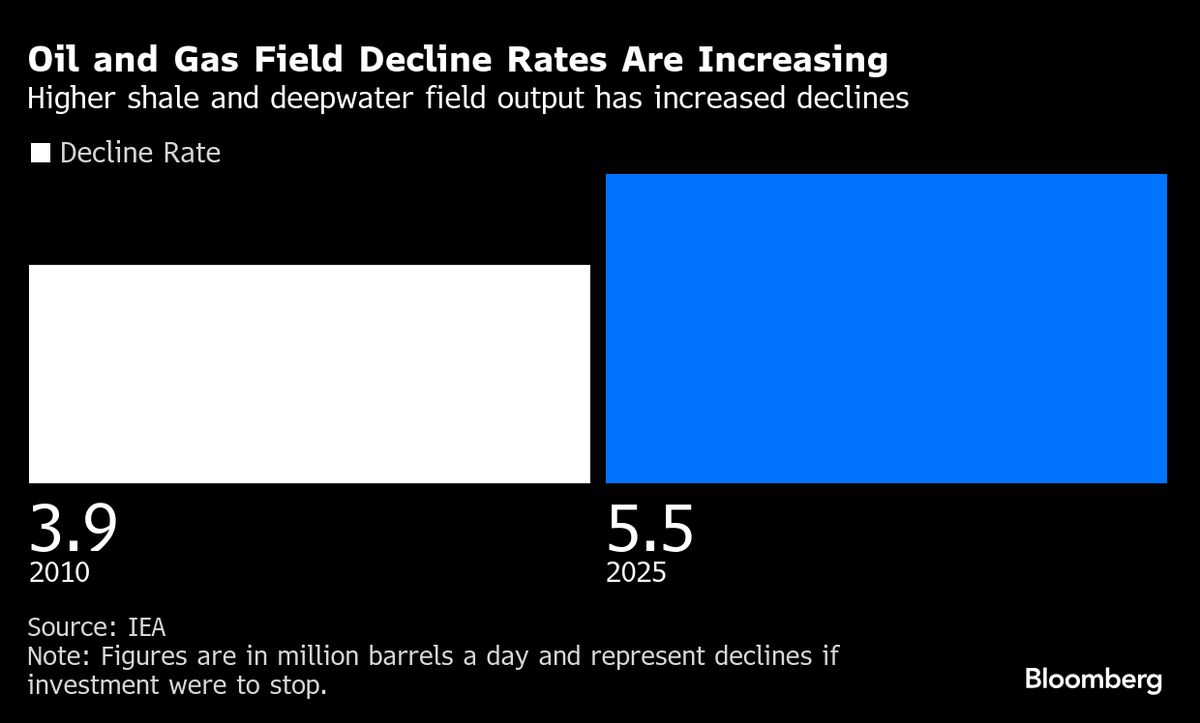

Decline rates in oil and gas fields accelerate, requiring more investment - IEA

NeutralFinancial Markets

The International Energy Agency reports that decline rates in oil and gas fields are accelerating, indicating a need for increased investment in these sectors.

Editor’s Note: This matters because as decline rates rise, companies must invest more to maintain production levels, impacting energy supply and prices globally.

— Curated by the World Pulse Now AI Editorial System