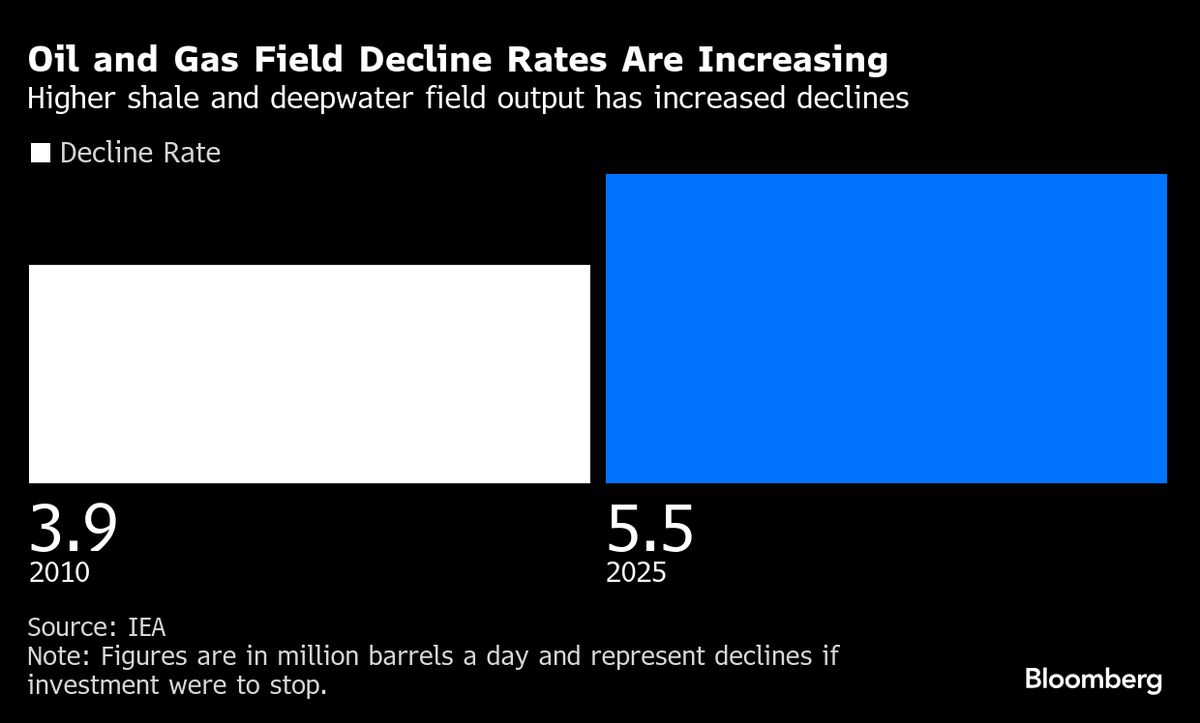

Global oil and gas field decline rates are increasing, IEA says

NegativeFinancial Markets

The International Energy Agency (IEA) reports that the decline rates of global oil and gas fields are increasing, indicating potential challenges for future energy supply.

Editor’s Note: This matters because rising decline rates could lead to energy shortages and increased prices, impacting economies and consumers worldwide. Understanding these trends is crucial for energy policy and investment decisions.

— Curated by the World Pulse Now AI Editorial System