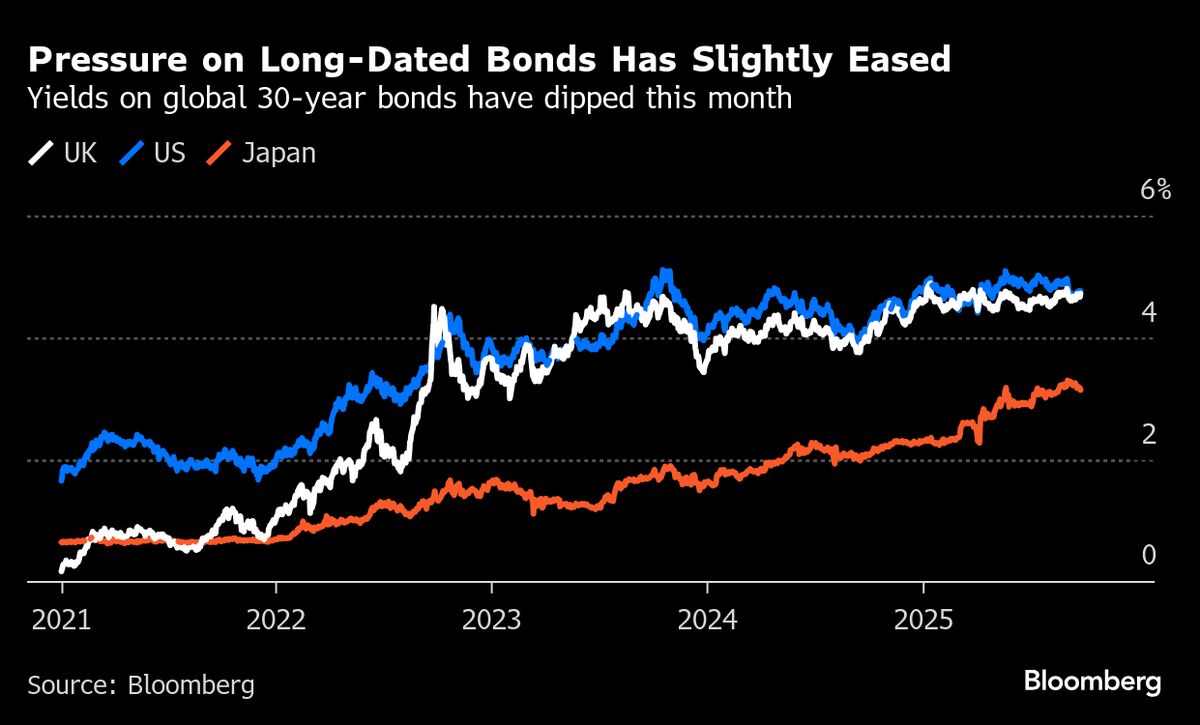

Long Bonds Suddenly Back in Vogue as Falling Supply Eases Nerves

PositiveFinancial Markets

Long-dated bonds are making a comeback as investors respond to easing pressure from supply changes and seek out bargains following a recent selloff. This shift is significant as it indicates renewed confidence in the bond market, suggesting that investors are finding value in these assets after a period of uncertainty.

— Curated by the World Pulse Now AI Editorial System