Citi sees choppier phase ahead for equity bull market

NegativeFinancial Markets

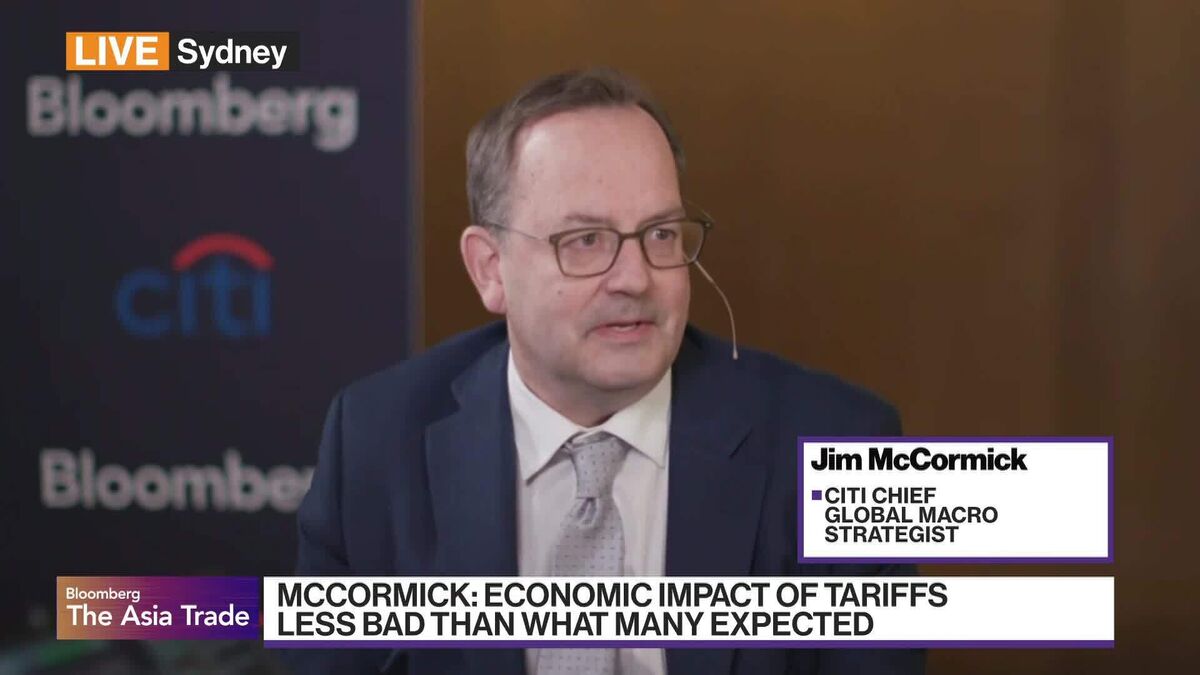

Citi has warned that the equity bull market may face a more turbulent phase ahead, indicating potential challenges for investors. This matters because it suggests that the current upward trend in stock prices could be at risk, prompting investors to reassess their strategies and possibly brace for volatility in the market.

— Curated by the World Pulse Now AI Editorial System