How Debt, Inflation and Politics Are Driving Up Borrowing Costs

NegativeFinancial Markets

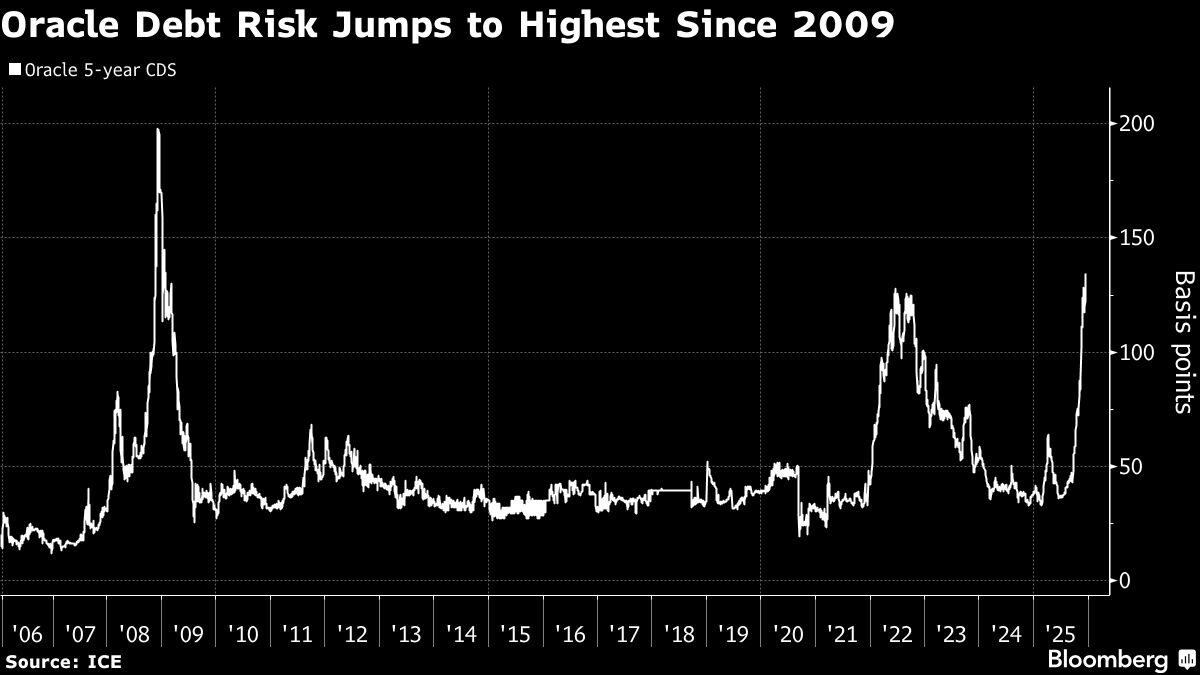

- A prolonged period of elevated long

- The rising borrowing costs are significant for governments and institutions, as they may hinder economic growth and limit the ability to finance public projects. This trend could lead to tighter fiscal policies and increased scrutiny of government spending.

- The current financial landscape reflects broader challenges, including the impact of rising home prices in Australia, which exacerbate inflationary pressures, and the scrutiny faced by hedge funds regarding their leveraged bond trades. These interconnected issues highlight the complexities of navigating economic recovery amid persistent inflation and shifting market dynamics.

— via World Pulse Now AI Editorial System