Oracle Debt Trades Like Junk as Bond, CDS Spreads Flare

NegativeFinancial Markets

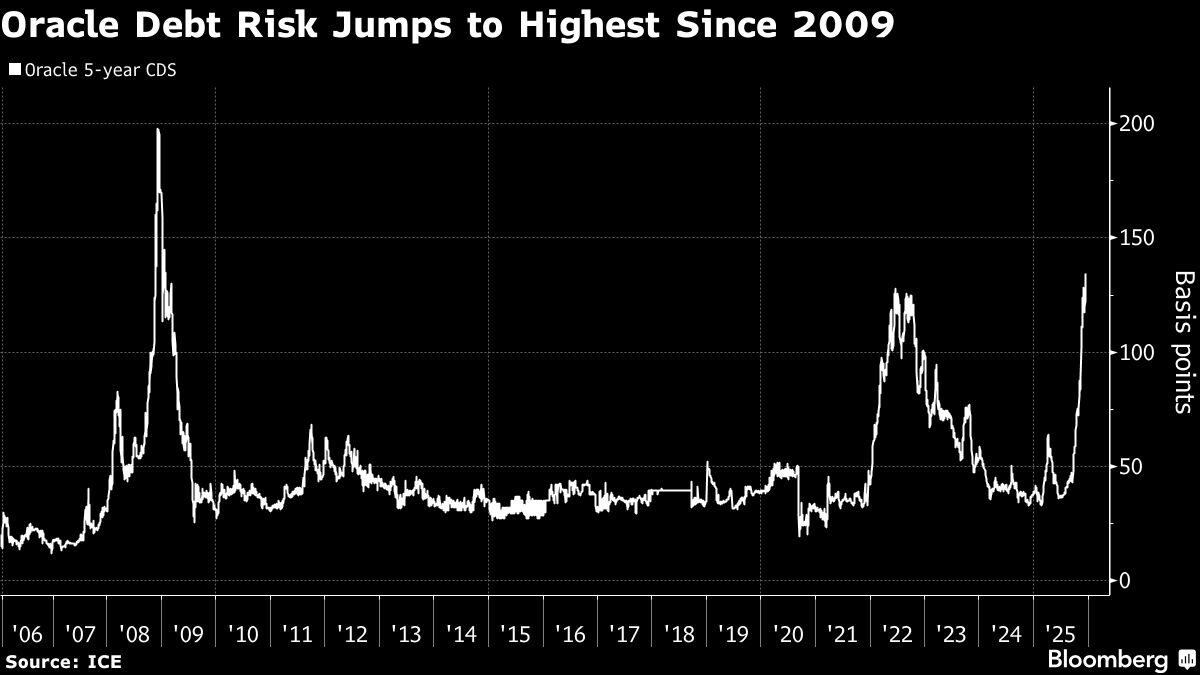

- Oracle Corp.'s new investment-grade notes are trading at levels typically associated with junk bonds, driven by delays in data center completions and concerns over profitability from its artificial intelligence investments. This shift reflects a significant deterioration in the company's credit risk, which has reached its highest point since 2009.

- The decline in Oracle's bond ratings and the widening spreads on credit default swaps indicate increasing investor skepticism regarding the company's financial health and its ability to generate returns from its substantial investments in AI technology.

- This situation highlights broader market trends, as the S&P 500 index recently hit a record high despite Oracle's struggles, suggesting a divergence in performance between individual tech stocks and the overall market. The rising credit risk amid fears of an AI bubble further complicates the outlook for tech firms heavily invested in this sector.

— via World Pulse Now AI Editorial System