Politics jolts markets as Japan stocks soar 4%, bitcoin leaps to record high with gold

PositiveFinancial Markets

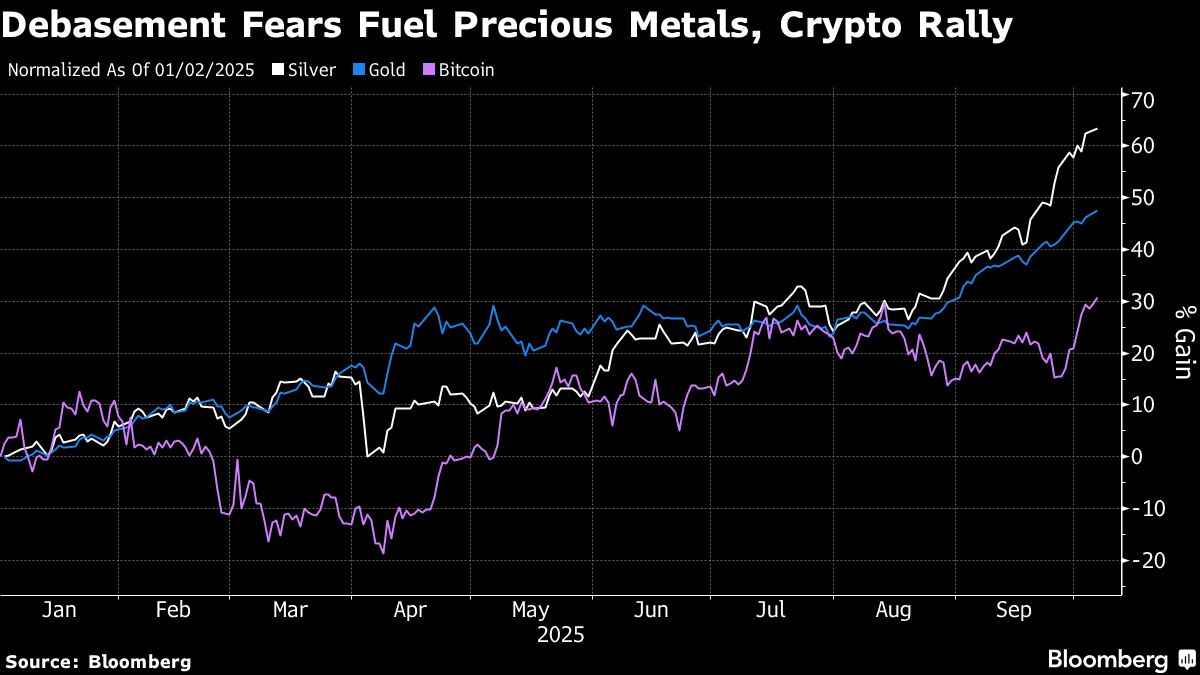

Japan's stock market has experienced a remarkable surge, soaring 4% amid political developments, while bitcoin has reached an all-time high, drawing significant attention. This surge is noteworthy as it reflects investor confidence and a potential shift in market dynamics, especially with gold also gaining traction. Such movements in the financial markets can influence global economic trends and investor strategies, making it a critical moment for both seasoned and new investors.

— Curated by the World Pulse Now AI Editorial System