Gold, Bitcoin Surge as ‘Debasement Trade’ Weighs on Currencies

PositiveFinancial Markets

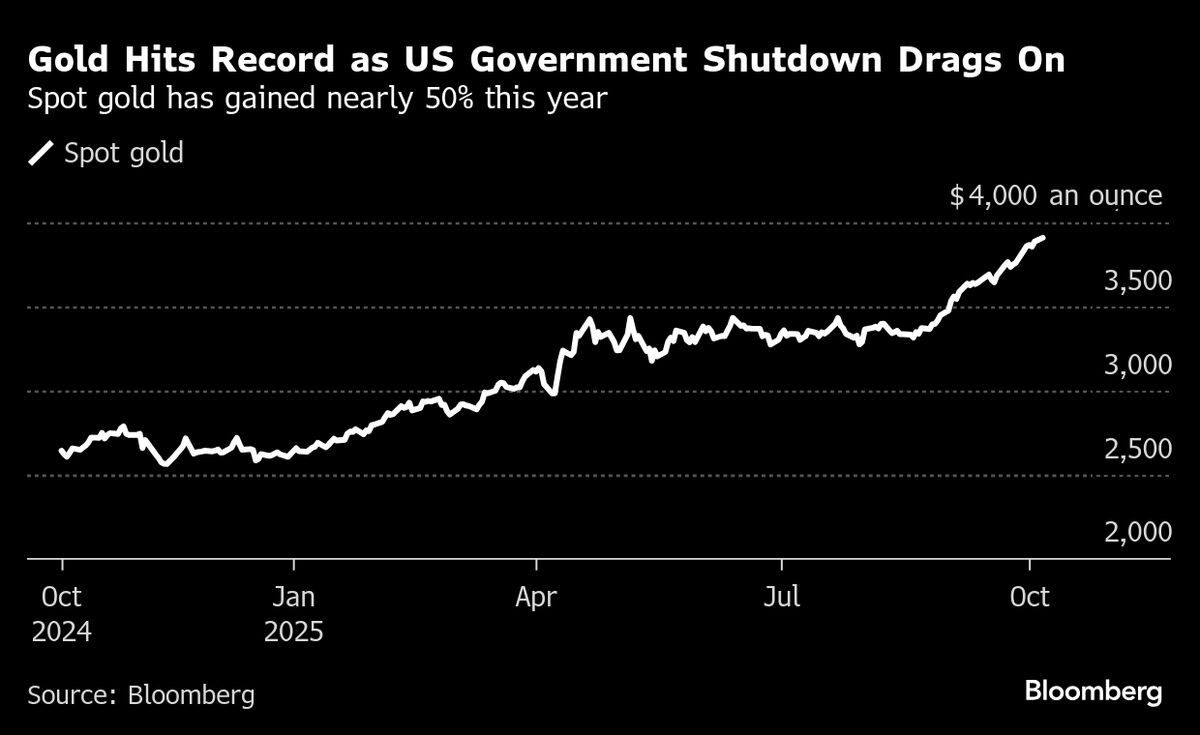

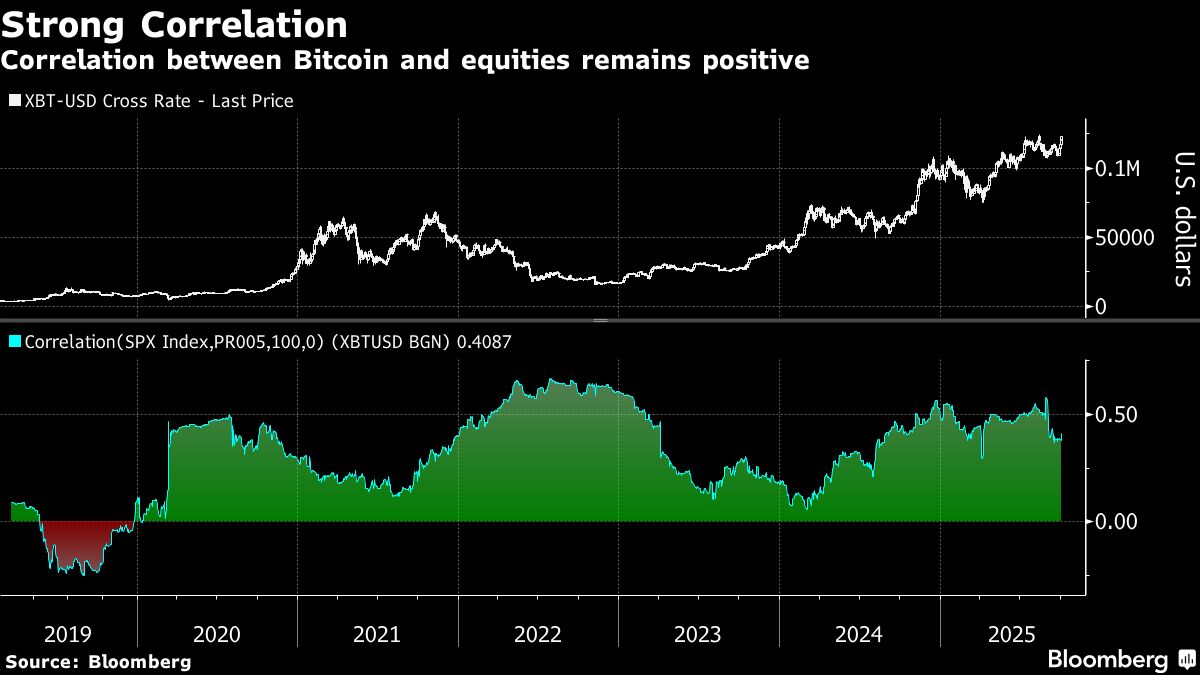

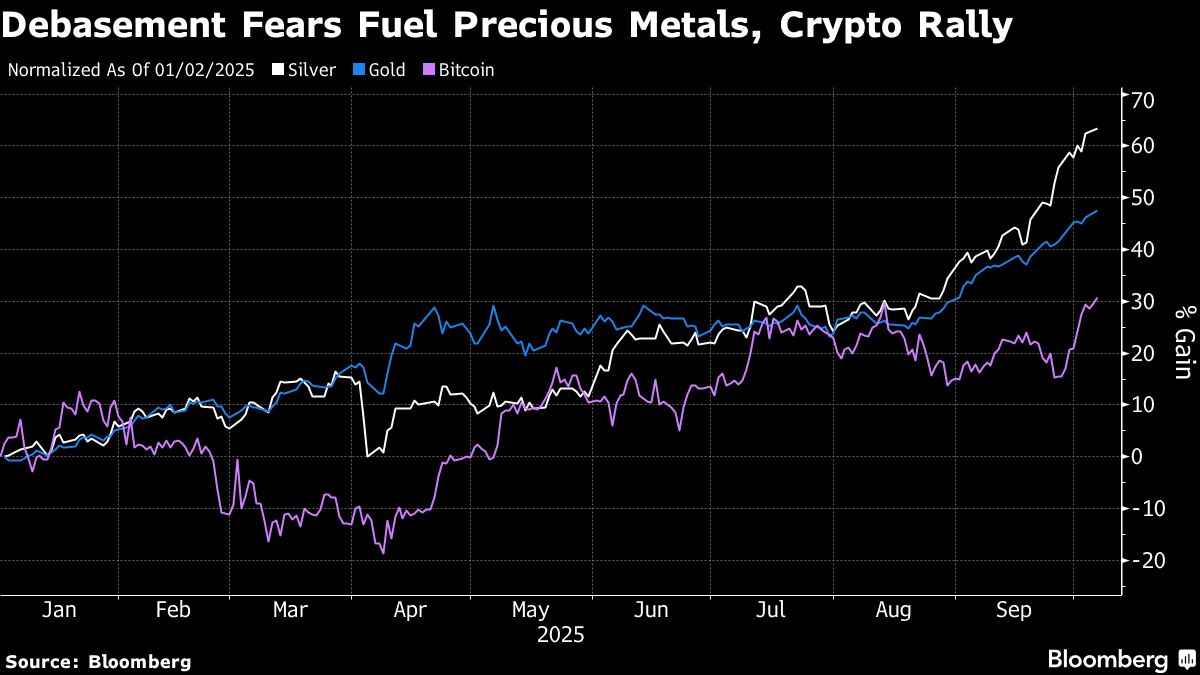

As concerns about fiscal stability rise in major economies, investors are increasingly turning to Bitcoin, gold, and silver, viewing them as safe havens. This trend, known as the 'debasement trade,' highlights a shift away from traditional currencies, reflecting a growing lack of confidence in them. The surge in these alternative assets not only indicates a changing investment landscape but also underscores the importance of diversifying portfolios in uncertain times.

— Curated by the World Pulse Now AI Editorial System