Redburn Analyst on His Call to Cut Microsoft, Amazon

NegativeFinancial Markets

- Analyst Alexander Haissl from Redburn has cut his ratings on Microsoft and Amazon to neutral, indicating concerns over the sustainability of the generative AI boom compared to cloud computing. He highlights economic weaknesses and high costs as critical issues.

- This downgrade is significant as it reflects a shift in investor sentiment towards major tech companies, particularly in the AI sector, which has been under scrutiny for inflated valuations and potential corrections.

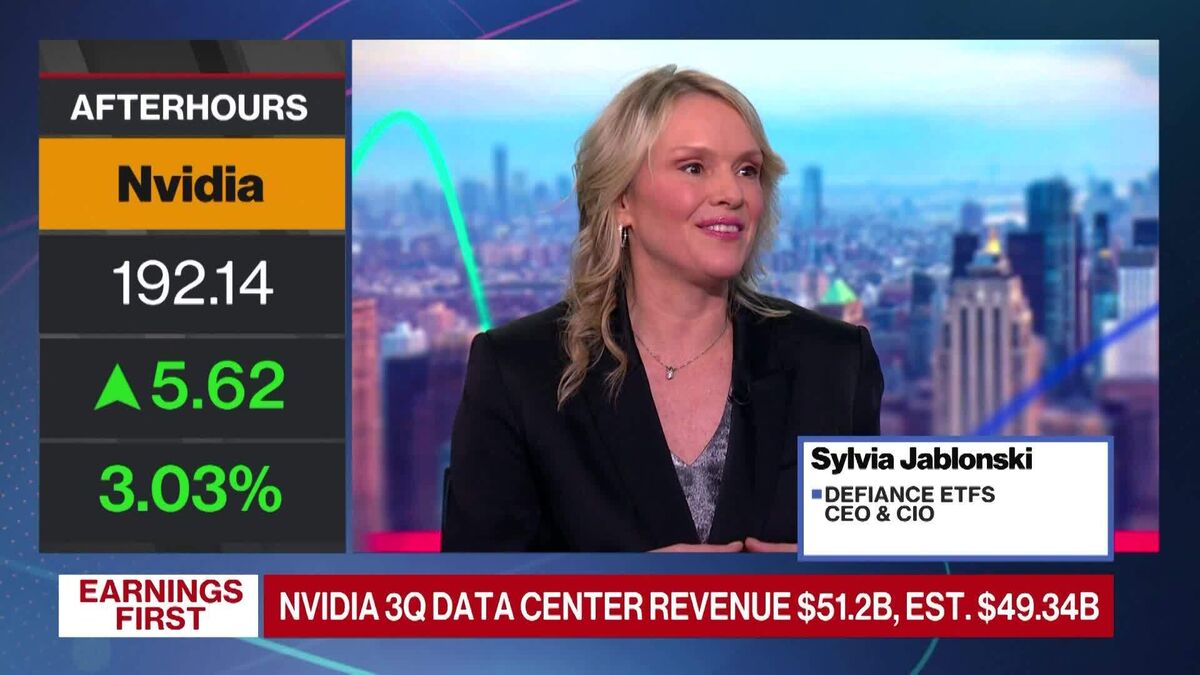

- The broader market is experiencing a selloff, with concerns about AI valuations impacting tech stocks, while companies like Nvidia and Baidu face challenges despite heavy investments in AI, suggesting a turbulent period ahead for the sector.

— via World Pulse Now AI Editorial System