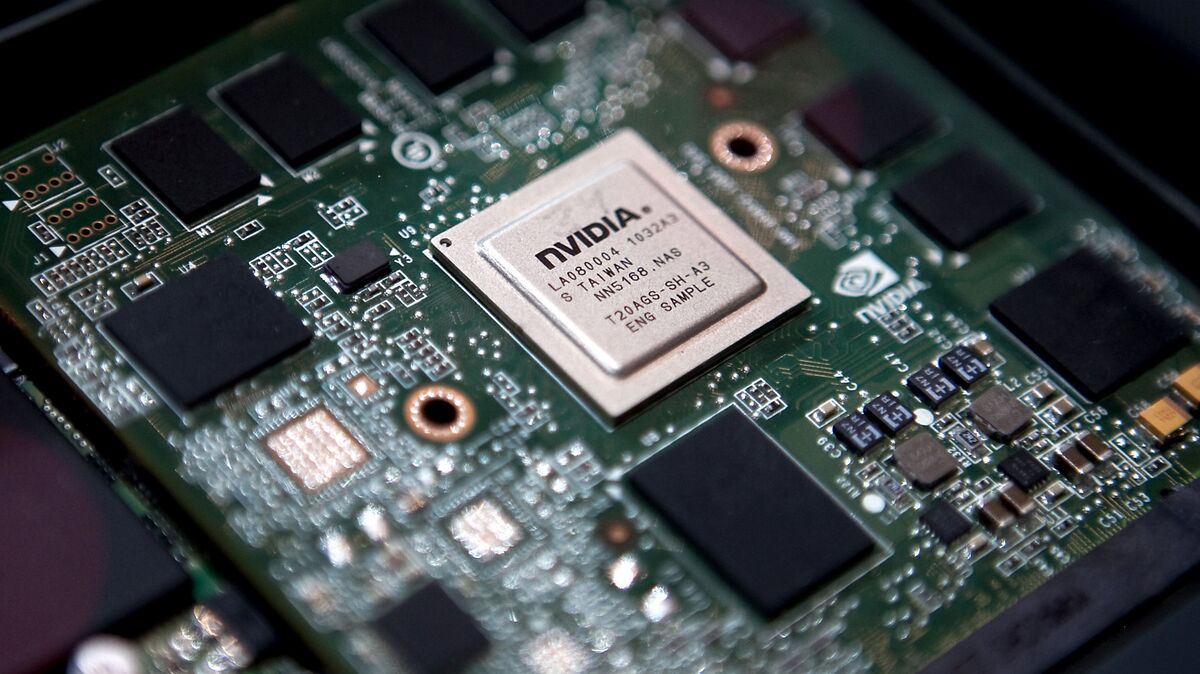

Goldman Sachs expects Nvidia ’beat and raise,’ lifts price target to $240

PositiveFinancial Markets

Goldman Sachs has raised its price target for Nvidia to $240, anticipating a strong performance from the tech giant. This optimistic outlook reflects confidence in Nvidia's ability to exceed expectations, particularly in the booming AI sector. Investors should pay attention, as this could signal further growth opportunities in the market.

— Curated by the World Pulse Now AI Editorial System