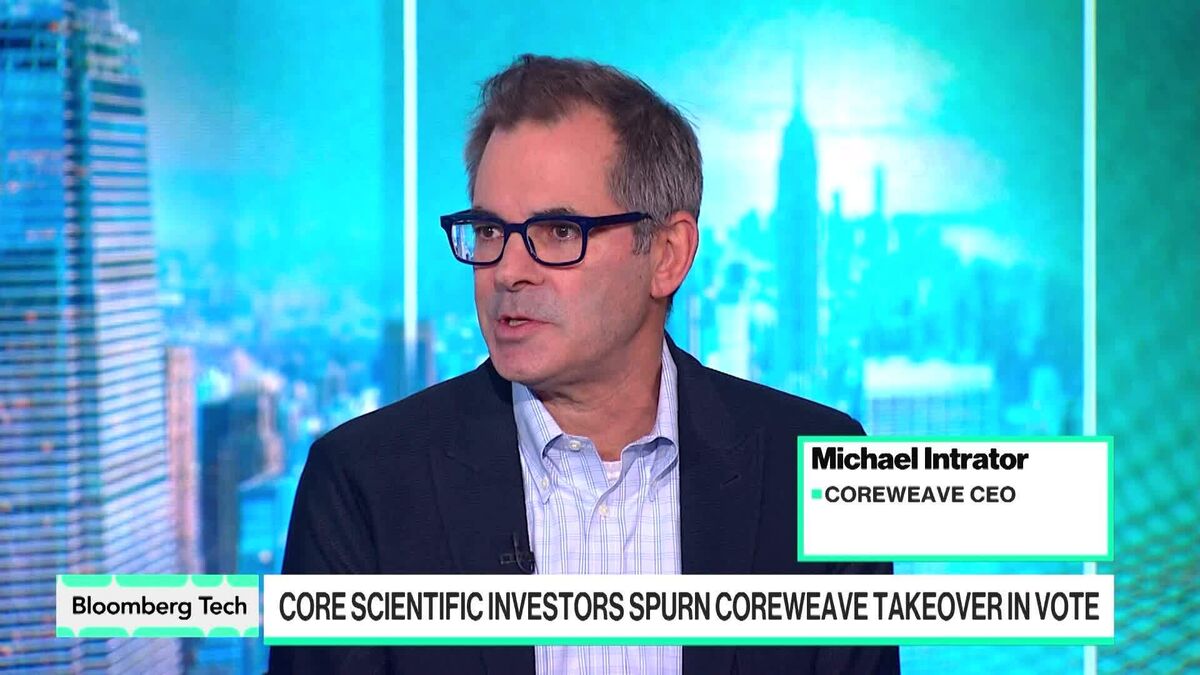

Core Scientific shareholders reject merger with CoreWeave, agreement terminated

NegativeFinancial Markets

Core Scientific shareholders have voted against the proposed merger with CoreWeave, leading to the termination of the agreement. This decision reflects the shareholders' concerns about the potential benefits of the merger and raises questions about the future direction of Core Scientific. The rejection of this merger could impact the company's growth strategy and its competitive position in the market.

— Curated by the World Pulse Now AI Editorial System