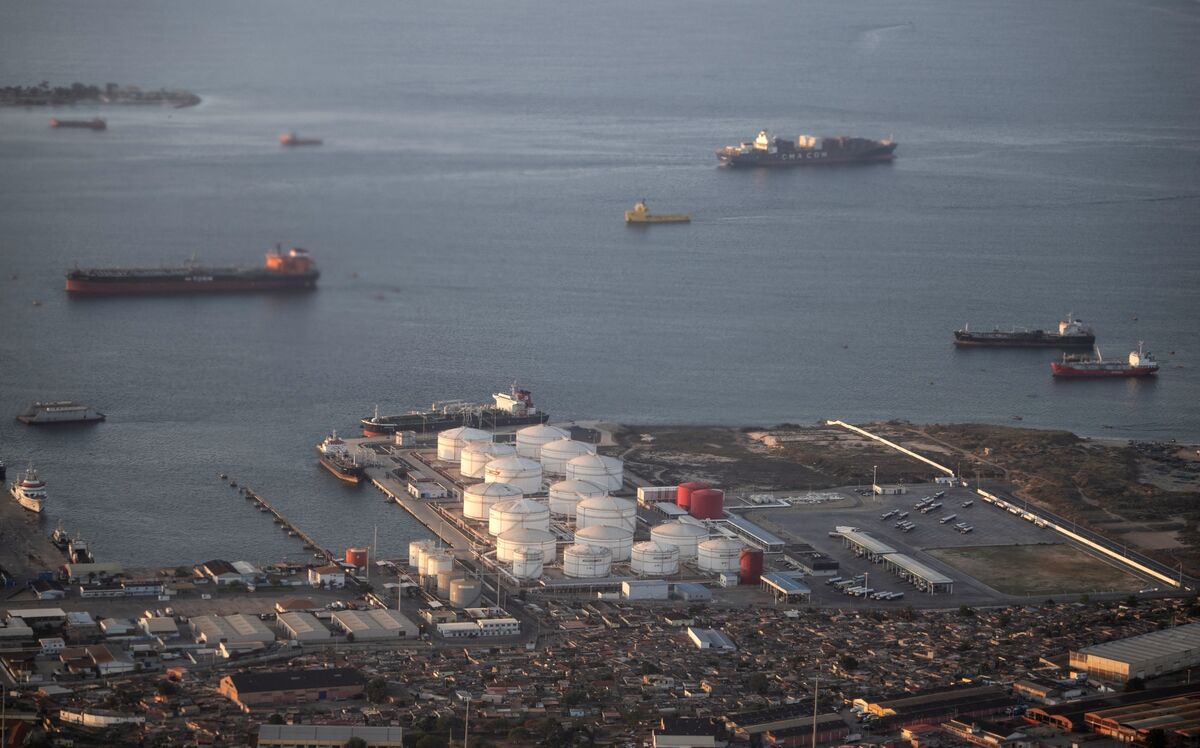

Angola’s Oil Output Rises Back Above Million-Barrel-a-Day Mark

PositiveFinancial Markets

Angola's oil production has made a significant recovery, surpassing the one million barrels per day mark in August after a two-year decline. This rebound is crucial for the country's economy, as oil exports are a major source of revenue. The increase in output not only reflects improved operational capabilities but also signals a positive trend for Angola's energy sector, which is vital for its economic stability and growth.

— Curated by the World Pulse Now AI Editorial System