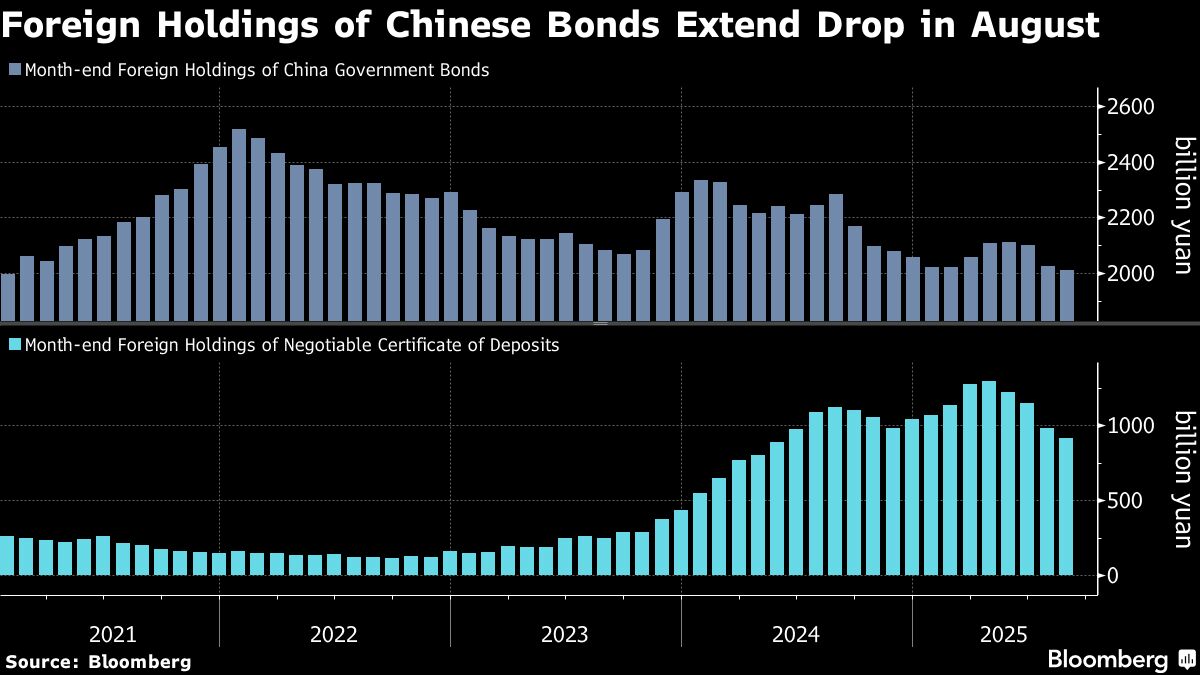

Global Funds Cut Holdings of Chinese Bonds to Lowest Since 2021

NegativeFinancial Markets

In August, overseas funds significantly reduced their holdings of Chinese sovereign bonds, bringing them to the lowest level since 2021. This trend is concerning as it adds more pressure to a debt market that is already struggling, especially with investors shifting their focus towards stocks. The implications of this shift could affect China's financial stability and investor confidence in its economy.

— Curated by the World Pulse Now AI Editorial System