Fed’s Schmid says rate cut was right move to offset job market risks

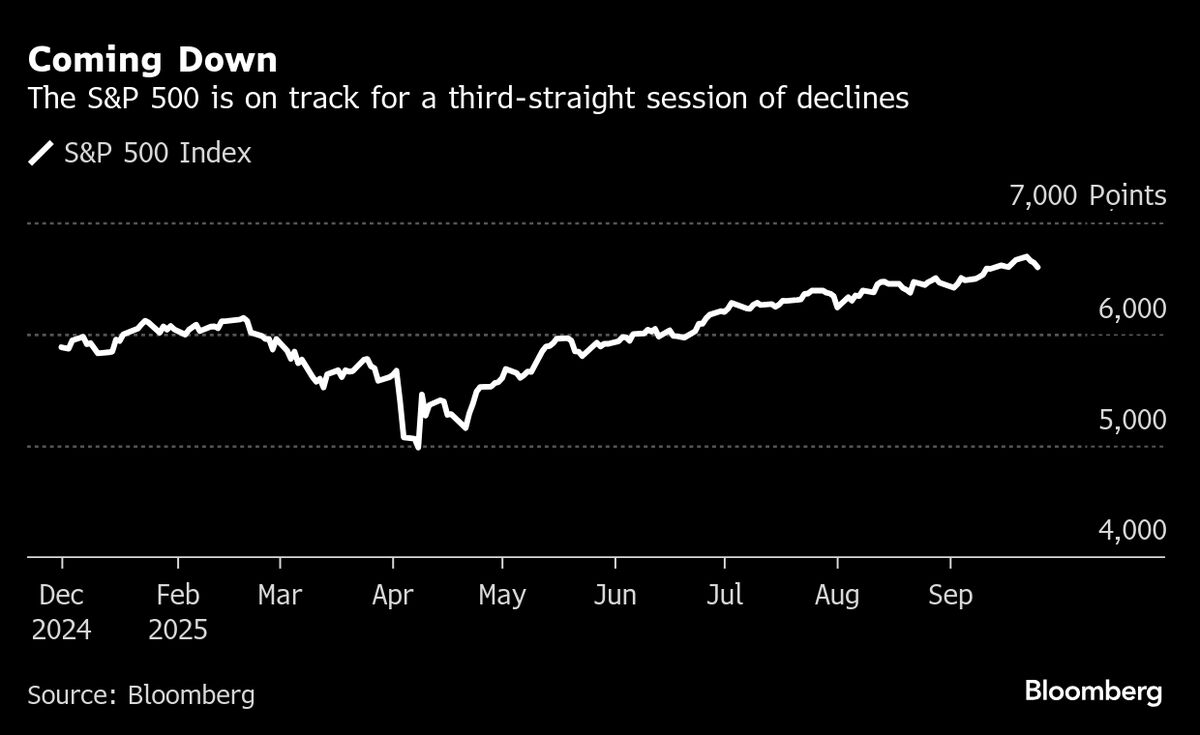

PositiveFinancial Markets

Federal Reserve official Schmid has expressed confidence that the recent rate cut was a necessary step to mitigate risks in the job market. This decision is significant as it reflects the Fed's proactive approach to ensure economic stability and support employment growth, which is crucial for overall economic health.

— Curated by the World Pulse Now AI Editorial System