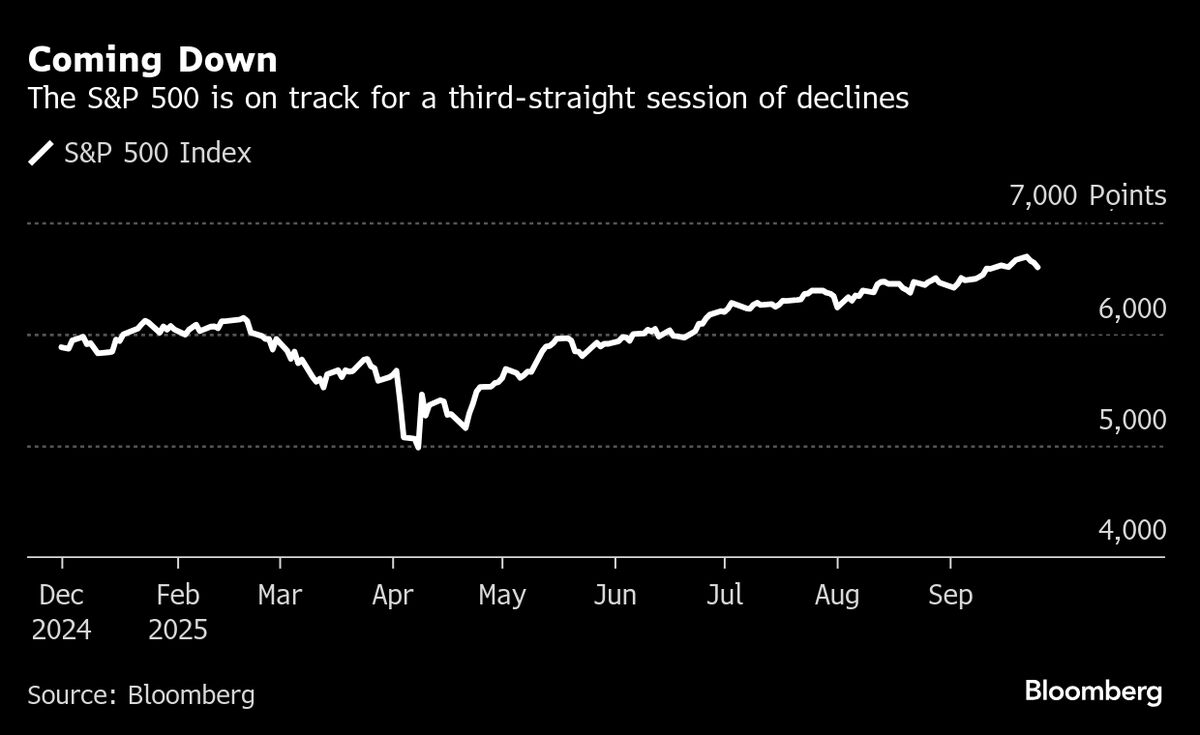

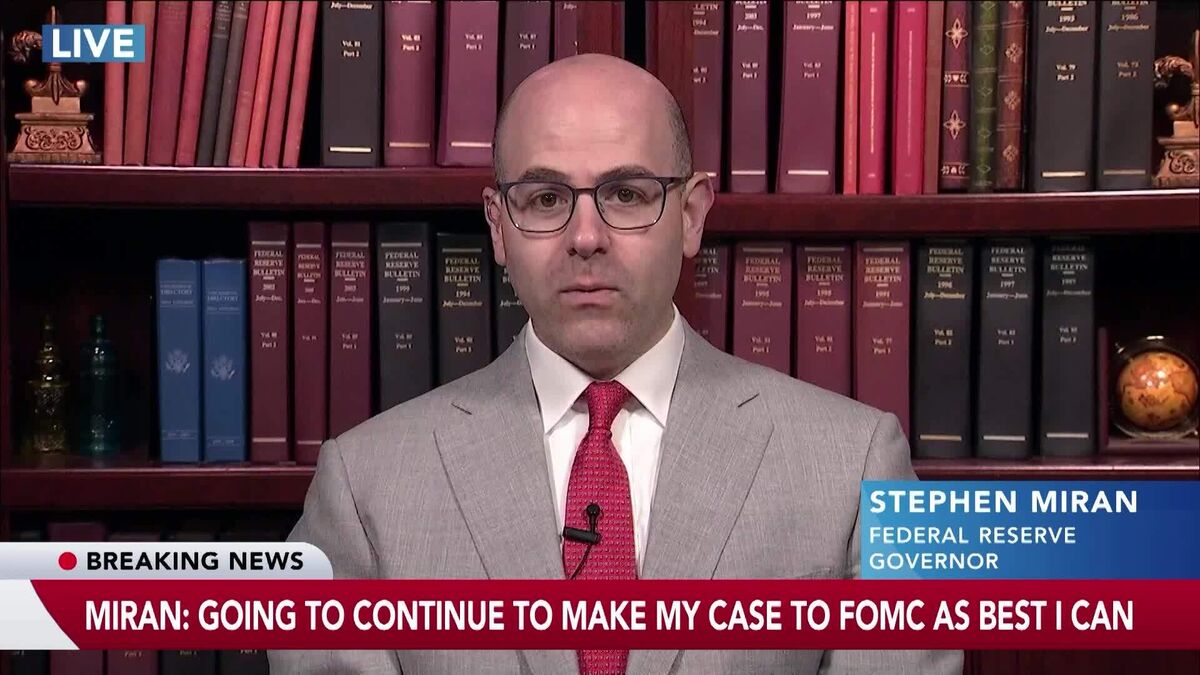

Fed’s Bowman Sees More Rate Cuts Amid Fragile Job Market

PositiveFinancial Markets

Federal Reserve Governor Michelle Bowman recently indicated that the current inflation levels are nearing the central bank's target, which opens the door for potential interest rate cuts. This is significant as it reflects a proactive approach to support the fragile job market, suggesting that the Fed is willing to take measures to stimulate economic growth. Such cuts could ease borrowing costs for consumers and businesses, fostering a more favorable economic environment.

— Curated by the World Pulse Now AI Editorial System